Step by step process to search property id in Rewari, check property tax, download property tax bill in Rewari, Rewari property tax online payment, generate no dues certificate etc.

The government of Haryana has provided its citizen’s option to check and pay property tax online through the Director of Urban & Local Bodies Haryana website https://ulbhryndc.org . Property owners from different areas in Haryana have the option to pay property tax using net banking, credit cards, debit cards, or digital wallets without visiting the municipal corporation office. In this article, we will let you know the process to check & pay Rewari property tax online and generate no dues certificate from the ULBHRYNDC website.

The Municipal Corporation of Rewari collects residential property taxes in the city of Rewari under the direction of the Department of Directorate of Urban Local Bodies of Haryana. The total property tax owed on each property in Municipal Corporation Rewari that is classified as residential, commercial, industrial, institutional, or government property is therefore determined.

How To Pay Property Tax in Rewari Online

Step 1: Open the ULBHRYNDC website from the link https://ulbhryndc.org

Step 2: Login with your phone number and OTP received on registered mobile number. If you haven’t registered yourself on this portal before follow the steps mentioned in the post Here

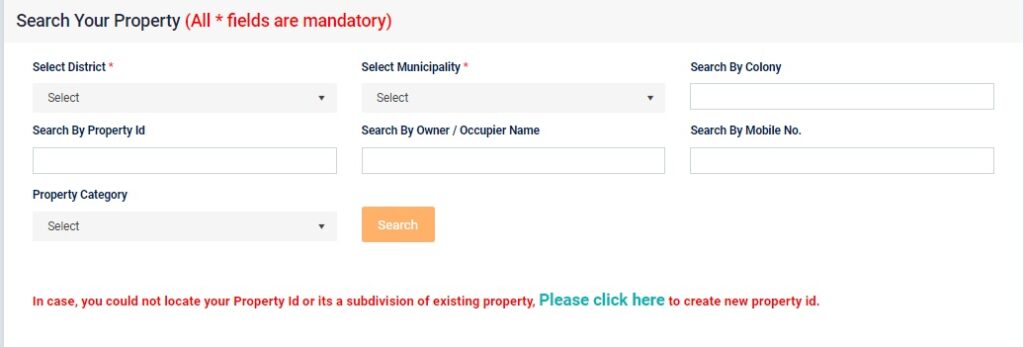

Step 3: After successful login a form will appear as shown in the image below

Select District as Rewari from drop down menu, Now select municipality from Bawal, Dharuhera or Rewari, Enter property Id as mentioned in your property tax bill and Click Search button

Step 4: Now details of property are listed below the form, Click on View Details button gainst the property

Step 5: Now the details of property like Owner name, address of property, size of property, property tax dues are visible on screen. Click on make payment button to pay the dues.

How is the tax calculated?

Residential real estate influences the amount of tax a person owes. Furthermore, the basement’s size, era, and occupancy type play a role. Taxes are levied on all commercial and non-residential real estate.

The applicant must disclose all new and existing construction and improvements to the state’s appropriate department to adjust the property’s tax assessment. Payment is made once the money has successfully passed through the required department.