Contents

ULB Haryana Property Tax

In this article, you will learn ULB Haryana Property ID registration through https://property.ulbharyana.gov.in portal, ulb haryana property id search by name haryana, online ulb haryana property tax payment, check property tax payment status, raising objections, generate no dues certificates, and check the status of their applications in Haryana.

During the last few decades, Haryana’s urban population has grown rapidly. The Department of Urban Local Bodies of Haryana(ULB Haryana) is in charge of maintaining the public utilities, including roads, sewers, parks, electricity, water, drainage, and collecting property taxes.

Every year, property owners in Haryana are subject to pay the property tax for their properties in the state. The Urban Local Bodies in Haryana use the money accrued to maintain the public facilities in the cities. For instance, one such tax imposed on Faridabad properties is the ULB Haryana property tax.

Once your Property ID has been successfully created, you can check the status of any outstanding debts owed on your property, pay your property tax online, download receipts, check the accuracy of your payments, file objections, and generate a No Dues certificate online.

ULB Haryana Property Tax Registration Process

You can now deposit the ULB Haryana Property Tax both online and offline, thanks to efforts made by the Haryana government. Following the steps below will allow you to register for the ULBHRYNDC portal online:

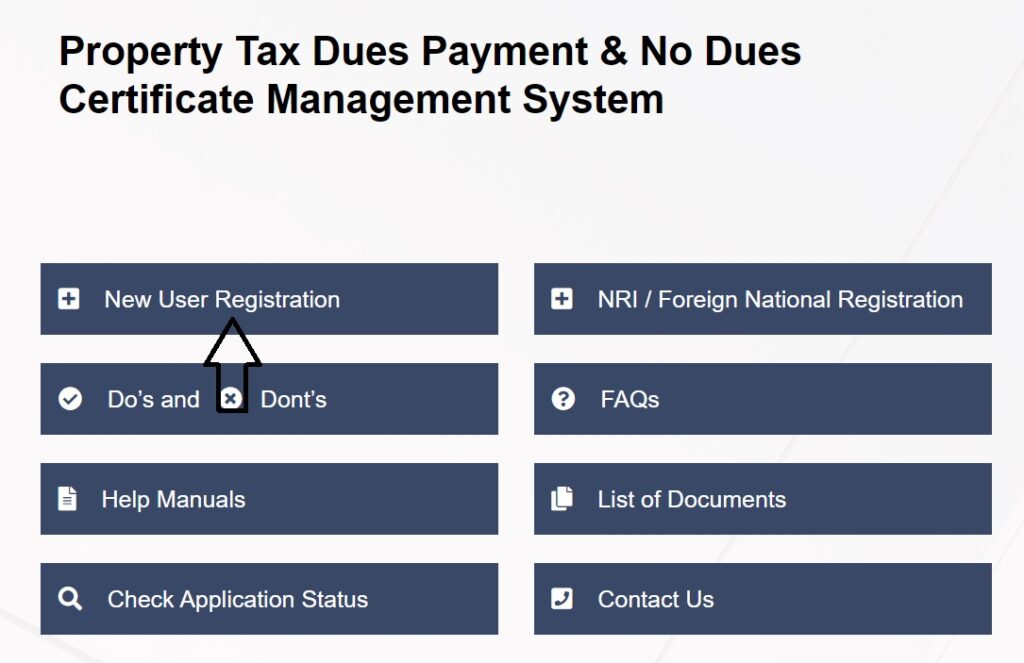

Step 1: First your have to visit ULB Haryana official website for property tax payment https://property.ulbharyana.gov.in/

Step 2: In the next step , Click on New Registration button as shown in the image below

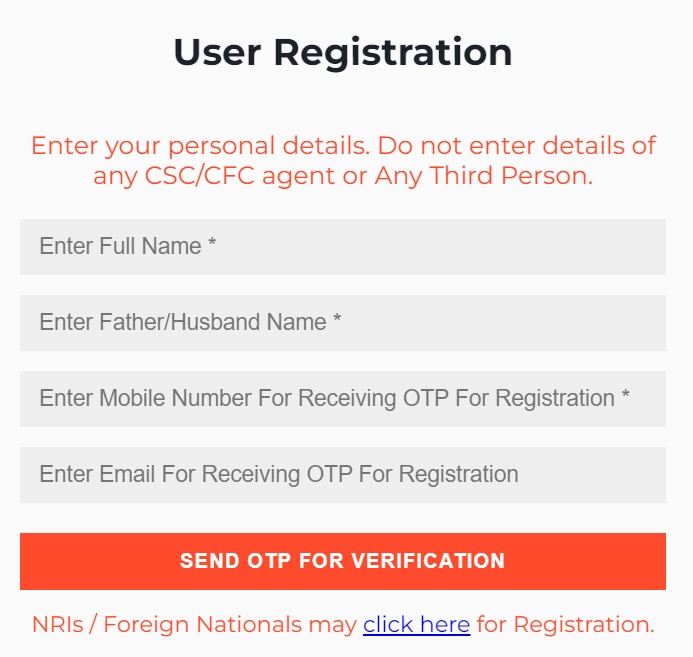

Step 3: Now Enter your Name, your Father’s or Husband’s Name, your Mobile number ad Emal ID then Click on the “Send OTP for Verification” button

Step 4: Now you will receive a six digit OTP on your mobile and Email ID, Enter the OTP received on both Email and Mobile Number in the space provided and click “Register” button.

Now the registration process to ULB Haryana portal is complete, you can Login with the registered mobile number. Note there is no password required to login to ULB Haryana portal. Every time you try to login you will receive an OTP on your registered mobile number.

Online ULB Haryana Property Tax Payment

- Open the Directorate of Urban Local Bodies, Haryana,’s Property Tax Dues Management and No Dues Certificate Management portal Open the website https://ulbhryndc.org

- Use your registered mobile number to sign in if you have already registered. The drop-down menu for Login Type allows you to select Citizen.

- Now Enter the One Time Password received on your registered mobile number in the space provided and click “Verify OTP and Submit”

- After successful Login, you will be asked to enter your property details like District, Municipality, Colony, Property ID, Owner Name, and Mobile number.

- After submitting property information you will get the property listed below the Search button, Click on the Select button against the property listed and you will get all information about the property including pending property tax.

- Now if you have any dues you can pay the same by clicking the Payment button.

Note: If you don’t have property ID you can just enter City, Area, and Owner name, by doing the same you will get all list of property with the searched name in that area.

How To Create ULB Haryana Property ID

Once you successfully registered yourself in ULB Haryana website you can search for property ID, create new ulbharyana property ID, pay haryana property tax online, download no dues certificate etc.

Step 1: Property ID Search By Name Haryana

- Click on Search Property button from Menu

- Now search your property by filling u details like District, Municipality, Colony, Property ID, Owner, Name or Mobile Number.

- List of all the properties with their details will be displayed

- If you have found your property in the list you can click Select button and pay dues. If the property is not listed then you have to create new property ID.

Step 2: Create New ULB Haryana Property ID

- If you don’t have ulb haryana property ID, you can create a new ULBHARYANA Property ID by clicking on “Please click here” button

- Read the terms and conditions and click on I Agree check box and click “click here to proceed” button

- Select the Name of the District, Municipality and Colony where your property is located.

- Mark your property in the map by identifying your property

- Click on “Next” to proceed.

- Select the typr of Ownership from the list, Enter the owner details. If there is more than 1 owner of the property, press the “Add Owner” button.

- Enter the Property & Construction Details. In case of more than one floor, press add more button again in construction details.

- Upload the required documents to support your application. All the documents are mandatory.

- Documents can be uploaded in the format: PDF, jpeg and png.

- Now select one of the PID Request type i.e, New PID Request or New PID Request under Tatkaal Scheme.

- If you select New PID request option, timeline is 10 Working days and no fee is charged.

- Read the declaration carefully and check the I agree box and click on “Submit Request” button.

How to Check the Payment Status on the Website for ULB Haryana?

After making an online deposit, a user can check the payment status on the ULB Haryana website. Then, follow the instructions above to confirm the online ULB Haryana property tax payment.

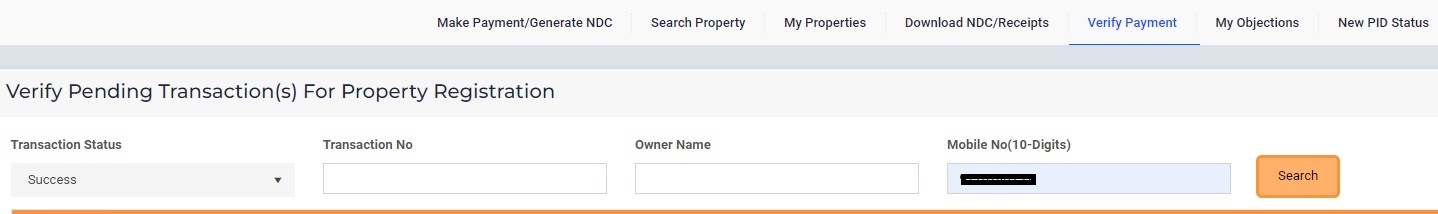

- Visit ULB Haryana Portal https://property.ulbharyana.gov.in/

- Select “Verify Payment” from the tabs at the top of the page

- The next window will show up.

- Now Select the Transaction Status and as well as the owner’s mobile number

- Select the search icon. The screen will display the payment status.

How can I obtain Property Tax No Due Certificate Online

For several reasons, a citizen may be required to present a no-dues property certificate. The Municipal Corporation is responsible for providing the applicant with a No-Dues certificate within 30 days of receiving the information. Both the customer facilitation center and the online portal are available. The No Dues Certificate in Haryana can also be downloaded online by following the steps mentioned below:

Step 1: Open the ULBHRYNDC website https://property.ulbharyana.gov.in/

Step 2: Log in with your mobile number and OTP

Step 3: Search for a property by entering property details

Step 4: Select the property to know about pending dues and make payment

Step 5: If all dues are paid you can click the Download NDC button to download the No Dues Certificate in Haryana

If you visit Municipal Corporation, the following papers are needed for the No Dues Certificate.

- Evidence of Property Ownership

- Buyer’s Affidavit (Notarized)

- Affidavit of the Seller(s) (Notarized)

- Copy of the registry and its chain of registries, if any

- Location Map of the Accepted Floor Plan

- Residence Tax Notice, Bill, or Receipt

- Evidence of Development Fees (Receipt) Paid to Municipality

- If the site is a construction site, documentation of the letter approving the building plan

- Court ruling or decision (if any)

- Earlier NOCs, if any