Contents

What is NDC Haryana Portal?

The NDC Haryana Portal https://property.ulbharyana.gov.in/ is an onine platform that provide property related services online in Haryana. The various services offered by NDC Haryana Portal are create new property ID, search property ID, property tax payment, download receipts, check NDC haryana status, download No Dues certificate, certify Property ID, verify payment, property ID verification, raise objections, link property ID with family ID, etc.

A No Dues Certificate is document that says you don’t owe any money or responsibilities for a property. The NDC(No-Dues Certificate) is important when you want to do property transactions , like buying or selling the property. The NDC Haryana Portal makes it easy for property owners to check NDC Haryana status, get No Dues Certificate in Haryana online.

NDC Haryana Update

1. Special discount for you by Haryana Government. Get 15 percent discount on property tax for the year 2023-24 by satisfying your property data located in urban areas. This opportunity only till 31.03.2024.

2. A one time rebate of fifteen percent shall be allowed on the principal amount of property tax arrears for the years 2010-11 to 2022-23 to those property owners who clear all the property tax arrears for the year 2010-11 to 2022-23 and also self-certify their property information on ‘Property Tax Dues Payment and No Dues Certificate Management System Portal’ by the 31st March, 2024.”

3. A one time waiver of hundred percent of interest on the arrears of property tax pending since year 2010-11 to 2022-23 shall be allowed to all tax payers, if their arrears are paid and also self-certify their property information on ‘Property Tax Dues Payment and No Dues Certificate Management System Portal’ by the 31st March, 2024”.

In simple words, the NDC Haryana Portal is a smart idea by the government to make property stuff easier. It helps cut down on paperwork, makes things clear, and helps the government work better.

Pay Online ULB Haryana Property Tax Through NDC Haryana Login

Step 1: Open the ULB Haryana NDC Portal https://property.ulbharyana.gov.in/

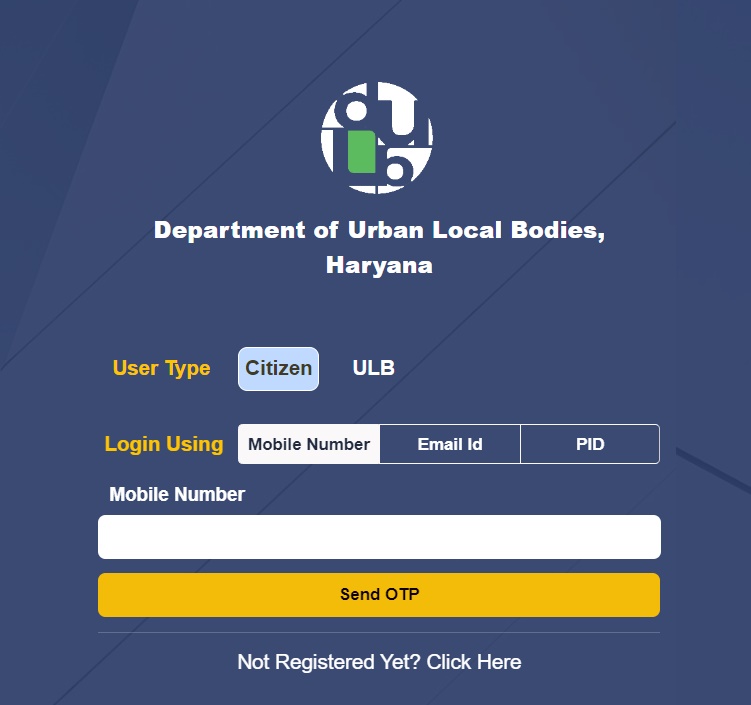

Step 2: There are two options Citizen and ULB Staff available, choose Login type as Citizen and enter your registered mobile number and Click Send OTP

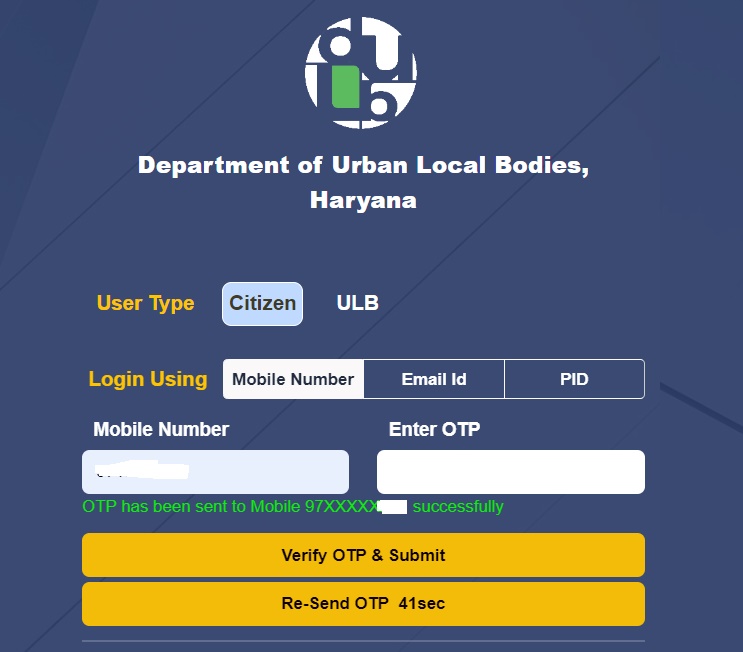

Step 3: Once the six digit OTP is received on the registered mobile number, Enter the OTP in the space provided and click “Verify OTP and Submit“

Step 4: Click on Make Payment/Generate NDC button from he menu

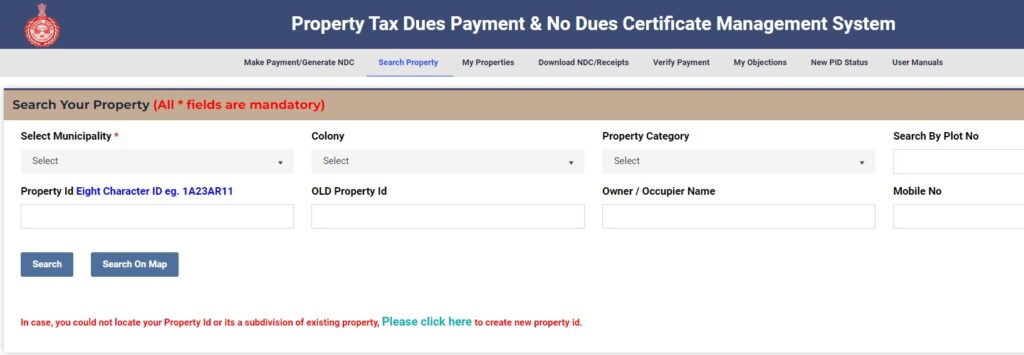

Step 5: Enter the Property ID if you have or Click the button as shown in the image to Search Property ID Haryana

Select Municipality, Colony, Enter property details like owner name, mobile number, old property id etc to search your property.

Step 6: Now all the properties with entered deails will be listed, click on view details of your property. your property is listed.

All the details of your property like owner name, area of the property, number of floors, and pending dues are now visible

Step 7: Click on the “Make Payment” button on the bottom and pay ULB Haryana Property Tax Payment

No Dues Certificate Download – Check NDC Haryana Status

First of all you have to make sure you have an active property ID on ULBHRYNDC Haryana portal, If you haven’t created account on NDC portal yet then follow the steps mentioned HERE. In order to check NDC Haryana status or download No Dues Certificate for your property in Haryana follow the steps mentioned below:

1. Visit the NDC Portal Haryana website https://property.ulbharyana.gov.in/

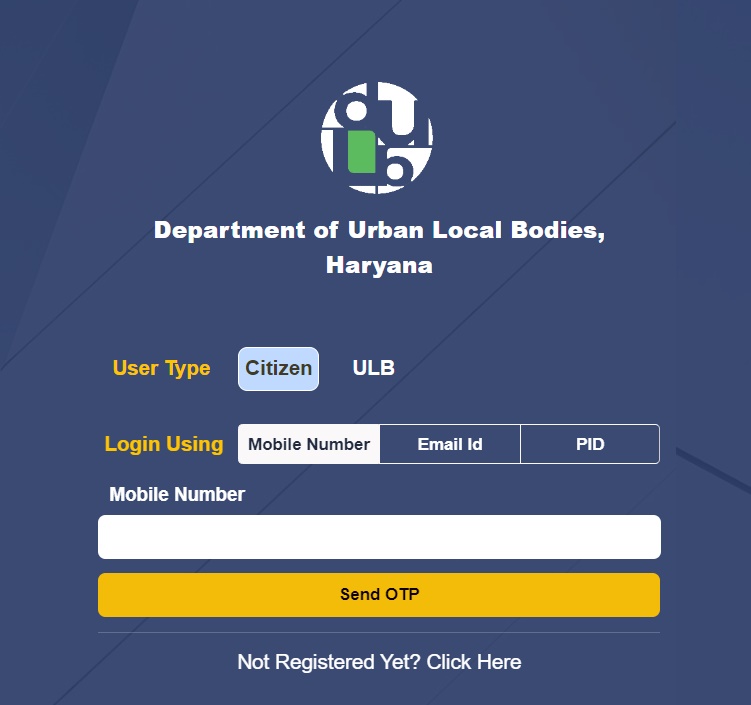

2. Now Select Login type as Citizen and Fill in the registered mobile number in the space provided and Click Login button

3. An OTP will be received on registered mobile number, Now Enter the OTP and click Verify OTP and Submit.

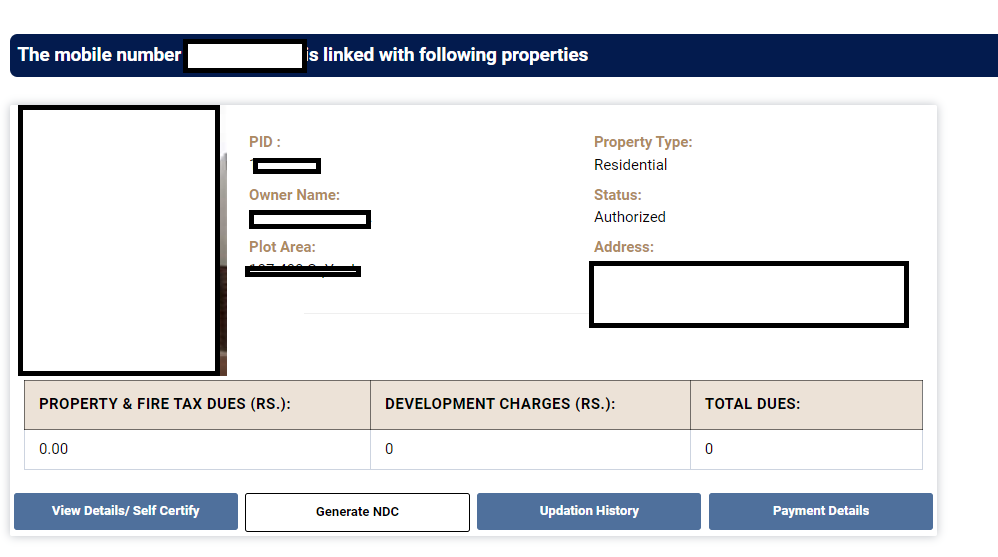

4. The property linked to the registered mobile number will be listed here, Click the “Generate NDC” button beside the property shown or you can Click Download NDC/Receipts from the menu

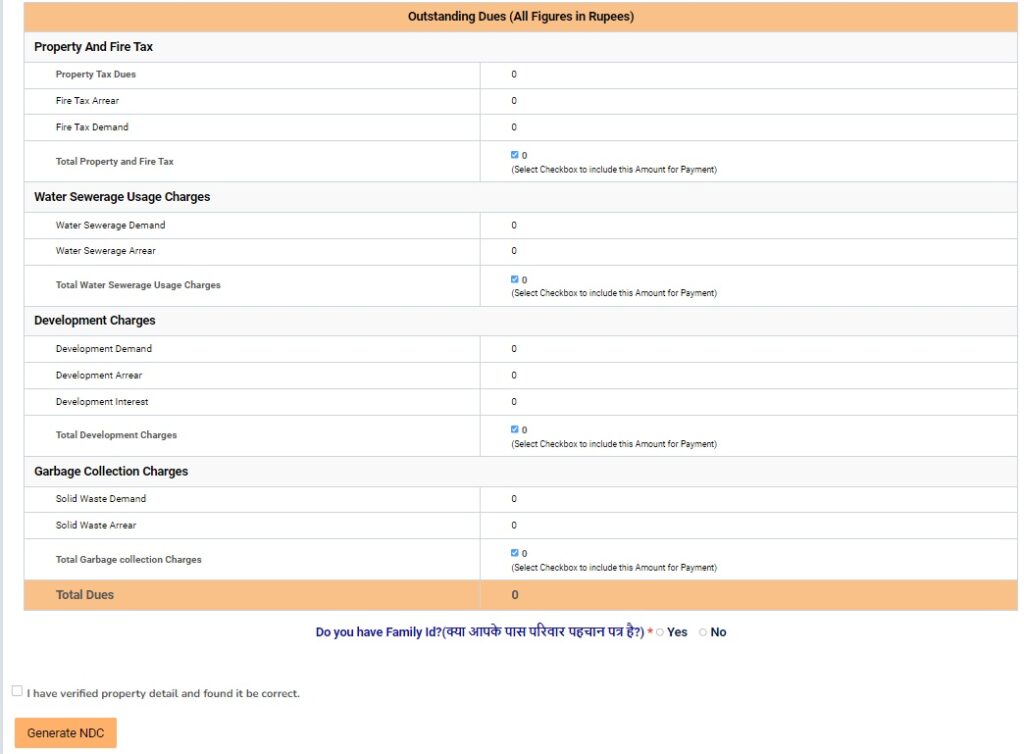

5. The outstanding dues against the property will be shown in the next window, If there are any dues present you have to pay the dues before being able to download No Dues Certificate Haryana by clicking the “Download NDC” button on the bottom of page.

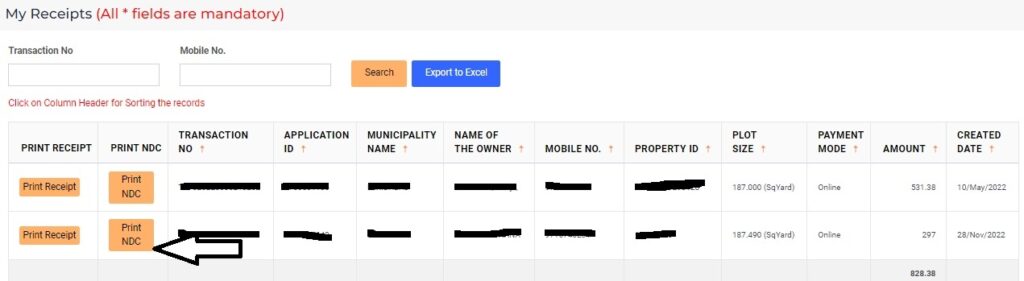

If you have clicked Download NDC/Receipts from the menu bar you will be shown a page where previous payments receipts are available. Check for the last payment and Click Print NDC button to download No Dues Certificate Haryana

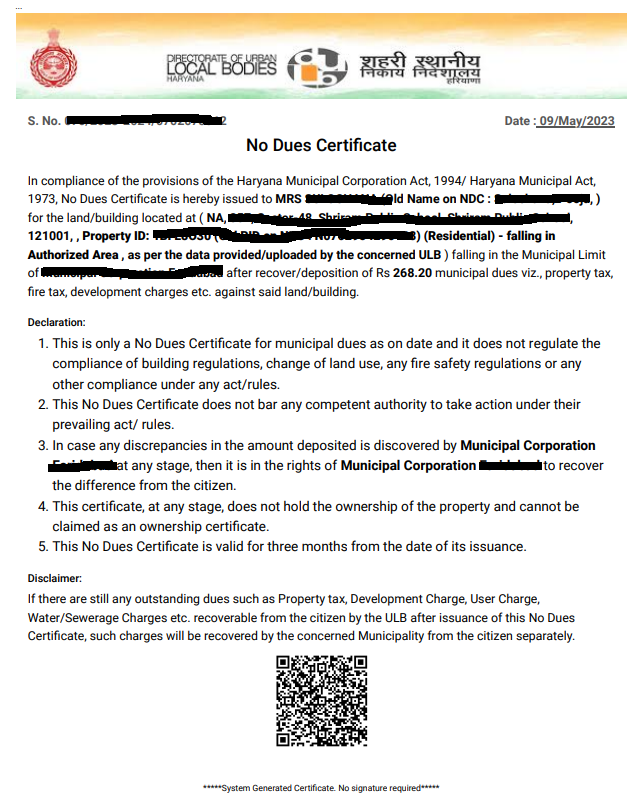

6. The newly generated No Dues Certificate will opened in new Window, Click on Print button at the bottom to download the certificate.

Frequently Asked Questions

What is the full form of NDC in property?

NDC stands for No Dues Certificate, it is a legal document to confirm there is no outstanding dues against the property. No Dues Certificate is required while doing property transactions like buying, selling or transfer of ownership.

How To Check NDC Haryana Status?

To check NDC Haryana status, visit the ULBHRYNDC website, Log in with your credentials and check dues against your property. If there are no dues against property ID you ca download the NDC certificate.

How Can I Check My Property Tax in Haryana?

In order to check your property tax in Haryana, you have to visit the official Property Tax Dues Payment & No Dues Certificate Management System https://property.ulbharyana.gov.in/ and Login with your User ID and Password.