Recently updated on August 13th, 2023 at 12:27 pm

Contents

ULB Haryana Property Tax Faridabad

Step-by-step process to Pay ULB Haryana property tax faridabad online payment, view & search MCF property tax online and download No Dues certificate in Faridabad

MCF Faridabad levies property tax on any lands and properties whether residential or commercial that come under their jurisdiction. A property tax is a direct tax charged by the state government that is used by the government to provide civic amenities. The Haryana government provides digital means to collect the property tax in Haryana through corresponding Municipal Corporation websites of various cities. In this article, we will discuss how to check MCF Faridabad property tax, pay mcf property tax online, and generate an MCF Faridabad house tax receipt.

MCF Faridabad is now accepting Property Tax payments in Faridabad online by entering the property details or by entering Property ID, If your property is new and the property ID is not generated by MCF Faridabad then you can also Create a Property ID Online in Faridabad through ULBHRYNDC portal (Urban & Local Bodies Haryana No Dues Certificate).

Faridabad is divided into 8 zones: NIT 1, NIT 2, NIT 3, Old 1, OLD 2, BLB 1, BLB 2, and Chandawali. MCF Faridabad Property Tax is charged yearly on the basis of the type of property, size of the property, and the usage of the property.

Also Read –

Steps To PAY ULB Haryana Property Tax Faridabad Online

To pay Property Tax Faridabad Online, one has to follow the steps mentioned here

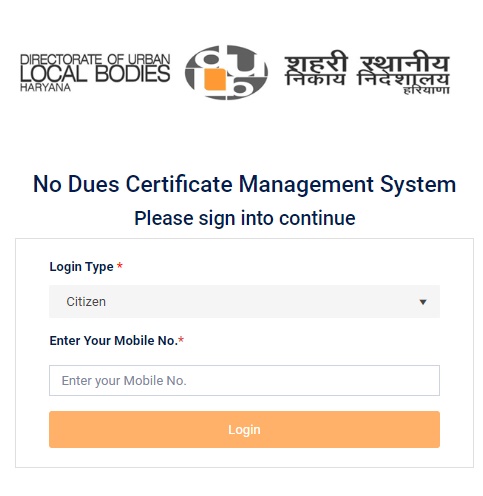

Step 1: Open ULBHRYNDC Portal https://ulbhryndc.org/

Step 2: Now Enter Your Mobile Number and Click Login

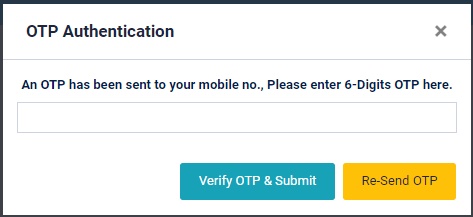

Step3: Enter 6 digit OTP Received on your Mobile number and Click “Verify OTP & Submit”

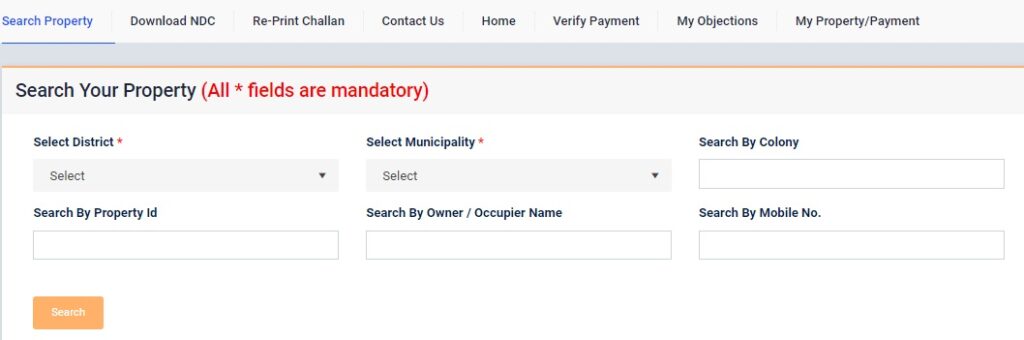

Step 4: The following page will appear:

Step 5: Search the Property by providing the following details:

- Select the District and Municipality

- Enter the Property ID of your property in the “Search By Property Id” field

If the property ID is not known you can Enter your Name in the Search by Owner Field and click search property. After clicking the search button a list of properties that match the details entered will be listed. If you can’t find your property here that means your property id is not created. Follow the steps mentioned here to Create New Property ID in Haryana.

Step 6: Click on Search Property

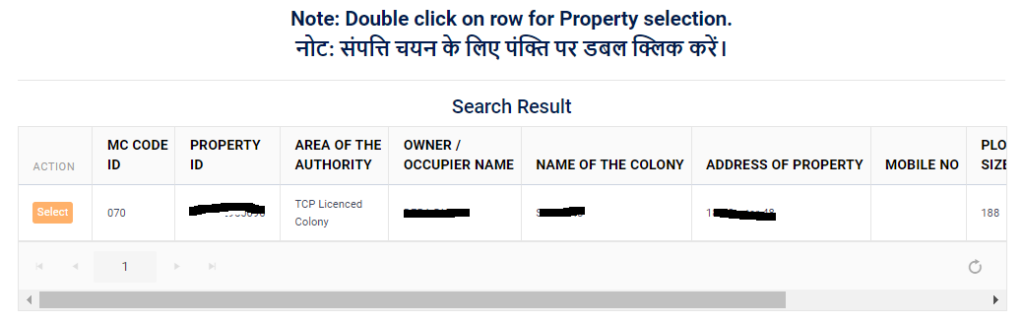

Step 7: The Property Details can now be seen on the screen. Click on the Select button or double-click the property.

Detailed information about the property is now available on the screen. The user can view all the submitted information while registering the property through this page. However, there is no option to edit/modify any information field.

Step-7: At the end of the page, there’s an option to Pay Property Tax.

Step-8: After verifying the details, click on the Pay PropertyTax button.

Step 9: You will be redirected to one of the payment methods. One can choose Credit Card, Debit Card, Net Banking, or any wallet for online payment.

After successfully paying the MCF Faridbada property tax you can take download the receipt or acknowledgment slip for future reference.

How to Pay Property Tax Faridabad Offline

To pay Faridabad property Tax offline, visit the MCF Office at B.K Chowk with the details of your property. Concerned officers available there will assess the property tax according to Size and Usage. You can fill in the amount at the cash counter and take the receipt.