Recently updated on June 26th, 2023 at 12:22 pm

Panchkula Property Tax Payment

Property tax is a municipality’s main source of income. It is a tax on real estate that the owner is obligated to pay to the local government for the property to exist. Although they have the potential to be a sizable source of income, in actuality, they are inefficient at bringing in the anticipated income.

The municipal corporation in Panchkula, which is governed by the Haryana Department of Directorate of Urban Local Bodies, is the recipient of property taxes for properties that comes under the municipal boundaries of the Panchkula district.

Every property, including residential, commercial, industrial, institutional, governmental, and undeveloped land, within the boundaries of a municipal corporation, is assessed for property tax, and those who have been assessed are responsible for paying the tax.

The Haryana government has actively taken into consideration the need to offer a variety of services in municipal areas via the internet. The Panchkula Municipal Corporation accepts online property tax payments in municipal areas through the online mode without any physical touch points in response to this.

Also Read:

How To Pay MC Panchkula Property Tax

In order to pay MC Panchkula property tax online has to register themselves on the Online Property Tax & No Dues Certificate Management website of Urban and Local Bodies Haryana. If you are not a registered user on ULBHRYNDC portal, you can register yourself by following the steps mentioned in the article here ULBHRYNDC Portal Registration.

After successfully registering as citizen in NDC Portal Haryana one can view and pay property tax online and downlod no dues certificate aganst their property. Follow the steps mentioned below to pay Panchkula property tax online.

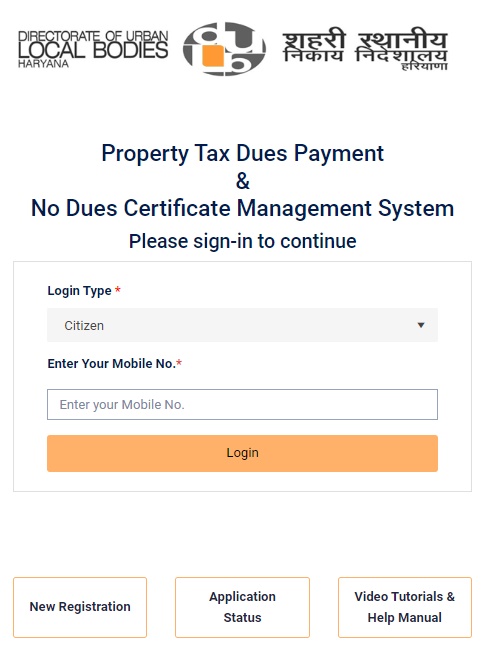

Step 1: Visit the official website of ULBHRYNDC(Urban and Local Bodies of Haryana) https://ulbhryndc.org

Step 2: Now select Login Type as “Citizen”, Enter your registered mobile number and Click the “Login” button

Step 3: An OTP will be received on the mobile number you entered, Enter the OTP received on the space provided, and then click the “Verify OTP & Submit” button

Step 4: A new page will appear where you need to fill in property details, Select District as Panchkula from the drop-down menu, Now Select municipality from Kalka or Panchkula whichever your property belongs to.

Step 5: Now you can search your property by entering your Colony name, Property ID, Owner Name, or Mobile Number.

Step 6: If you are not sure about the above details just fill in the owner name and all the properties with that owner name will be listed below, Now select the property which matches your address in the list.

Step 7: Once you click the Select button against the property you will see the pending property tax dues

Step 8: Pay the pending dues against your property with Netbanking, Wallet, Debit Card, or Credit Card, and save the receipt for future refrences

After they pay, you’ll receive an acknowledgment number that serves as proof of payment. Keep it for future reference.

A citizen’s property is assessed annually, while properties are assessed every five years. If the taxpayer fails to pay on time, interest at the rate of 1.5% per month is charged.

Each year, the first installment can be paid by April 30 and the second installment by October 30. Anyone who undervalues the property faces consequences.

Consequently, be sure to pay the property tax on time.