Recently updated on March 27th, 2024 at 06:51 pm

Contents

ULB Haryana Property Tax Introduction (ULBHRYNDC)

How to search your ULBHRYNDC property id in Haryana & pay property tax online in Haryana, download property tax payment receipt Haryana, and Download No Dues Certificate in Haryana through ULBHRYNDC portal https://property.ulbharyana.gov.in/

If you own a property in Haryana and want to pay property tax online Haryana then this article is for you. Haryana government has come up with a single portal ULBHRYNDC website to pay ulbhryndc property tax online and generate no dues certificate.

Citizens who wish to pay property tax online in Haryana needn’t visit their respective municipal corporation offices as property tax in Haryana can be paid online from now on. Moreover if one chose to pay property tax online he gets a discount in property charges for cashless transactions.

In this post, we will share details for paying property tax online in Faridabad.

ULBHRYNDC Haryana Login

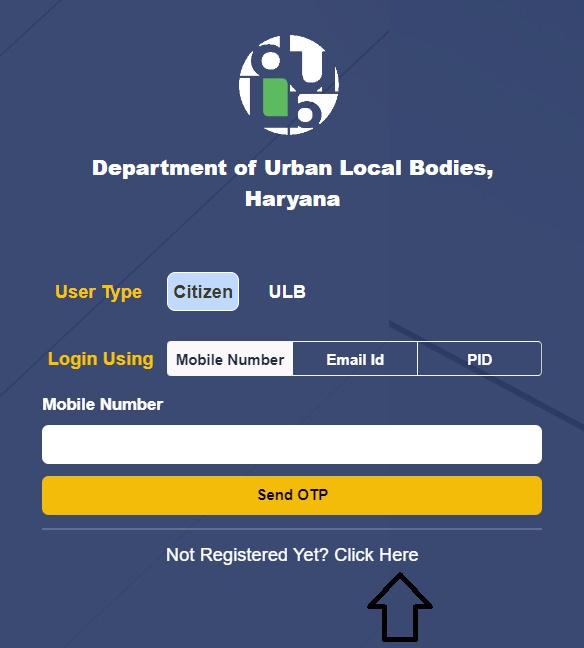

If you don’t have account on ULB Haryana portal then first of all you have to create your account so that you can pay haryana property tax online. Here are the steps involved to create account on ULB Haryana portal

- Step 1: Open the website https://property.ulbharyana.gov.in/

- Step 2: Click on link “Not Registered Yet? Click Here” as shown in the image

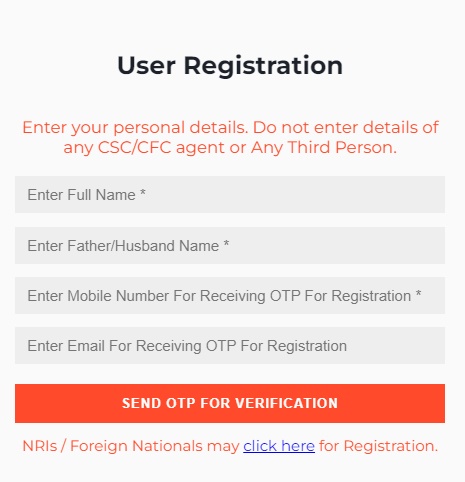

- Step 3: Fill in the details like Full Name, Father’s Name, Mobile Number, Email ID

- Step 4: Click “Send OTP for Verification” button

Step 5: Enter OTP received on mobile and email in the space provided and Click on Register button

Steps to Pay ULBHRYNDC Property Tax Online Haryana

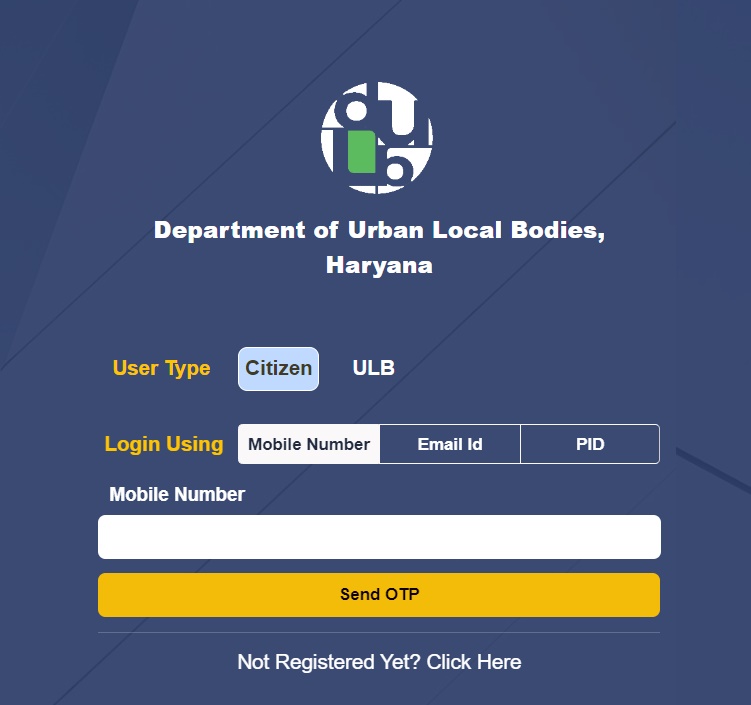

- Step 1: Open Website https://property.ulbharyana.gov.in/

- Step 2: Select User type as ‘Citizen‘ & Login Using as ‘Mobile Number‘ and Enter Your Mobile Number and Click ‘Send OTP‘

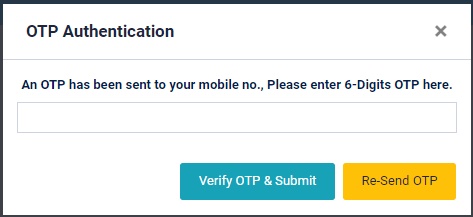

- Step 3: Enter OTP Received on your Mobile number

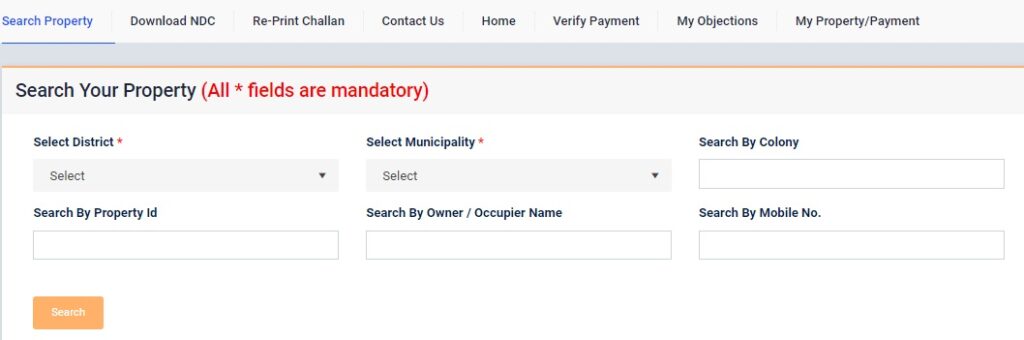

- Step 4: The following page will appear:

- Step 5: Search Property by providing the following details:

- Select the District and Municipality

- Enter the Property ID of your property in”Search By Property Id” field

If you can’t find your property here that means your property id is not created. Follow the steps mentioned here to Create New Property ID Haryana.

- Step 6: Click on Search Property

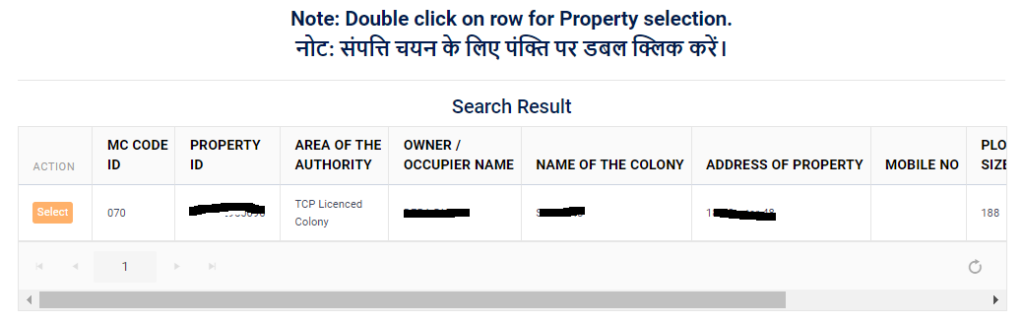

- Step 7: The Property Details can now be seen on the screen. Click on Select button or double click the property .

The detailed information about the property is now available on the screen. The user can view all the information that was submitted while registering the property through this page. However, there is no option to edit/modify any information field.

- Step 8: At the end of the page, there’s an option to Pay Property Tax.

- Step 9: After verifying the details, click on Pay Property Tax button.

- Step 10: You will be redirected to one of the payment methods. One can choose Credit Card, Debit Card, Net Banking or any wallets for online payment.

Similarly, you can pay municipal corporation property tax online for Gurgaon, Hisar, Ambala, Karnal, Panipat, Rohtak, Sonipat, Panchkula, Manesar, etc.