Recently updated on September 3rd, 2022 at 11:13 am

Contents

Know the process for Instant PAN Card Application with Aadhar online without any documents, How to download an e-PAN Card, and the benefits of instant E-PAN.

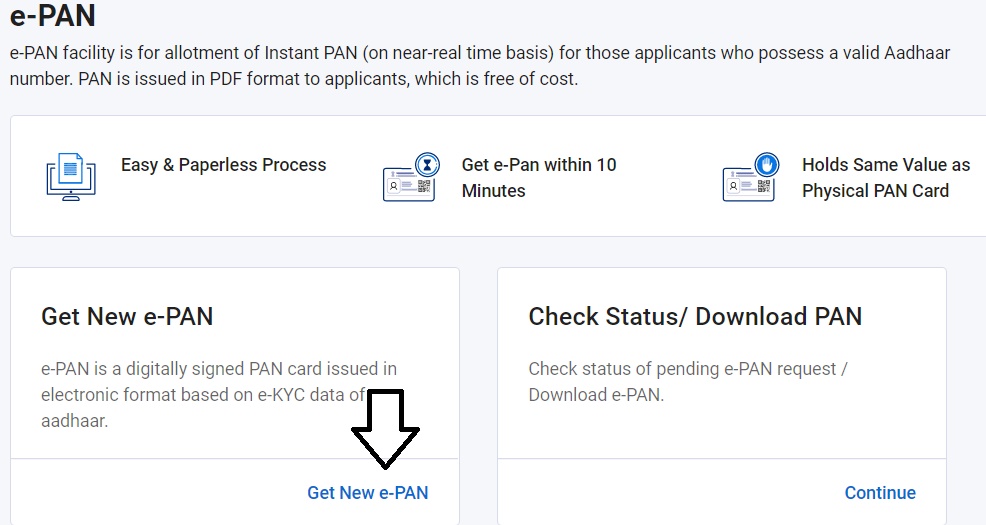

Income Tax Department has recently introduced a new feature to generate an Instant PAN Card using an Aadhaar Card number. The process of applying for Instant PAN through Aadhaar Car is entirely online and it will take only 10 minutes to generate E PAN through Aadhaar. There is also no need to submit any documents for verification as all the details of individuals are verified through Aadhaar card number. This feature is totally free, and anyone can use it from the official website of Income Tax.

The Instant E-PAN generated via the Income Tax website is equivalent and possesses the same value as the PAN card issued after filling up the detailed application form. The instant E-PAN generated through Aadhaar contains a QR code that holds the demographic details of the individual like the name, date of birth, and photograph. It is necessary for the candidate to have an Aadhaar Card and the mobile number linked with it in order to get an instant PAN Card.

Who Can Generate Instant E-PAN Card

A person has to adhere to some simple requirements to obtain this feature for oneself. The details are listed below:

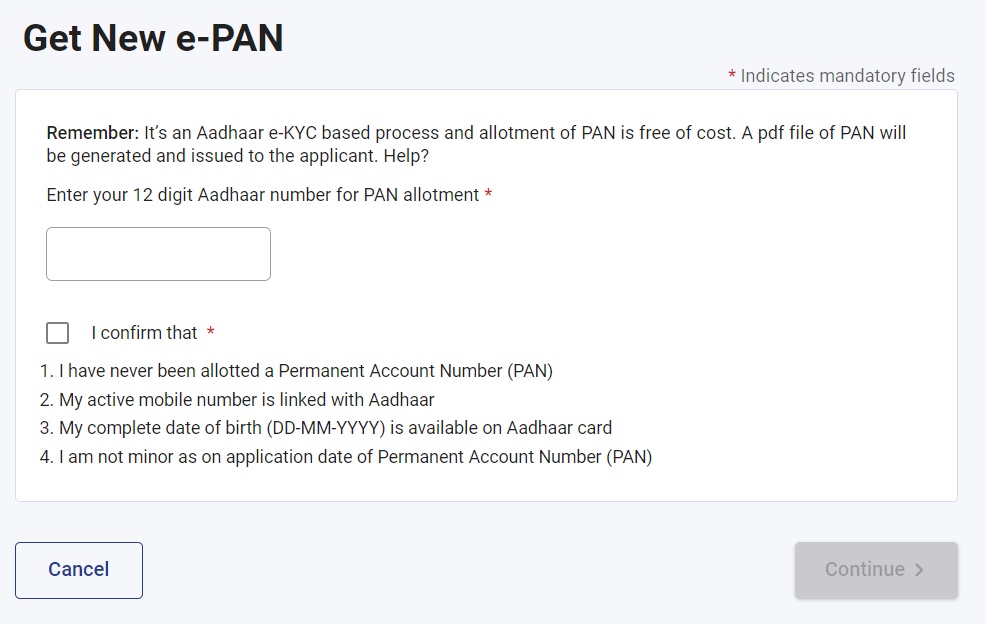

- The candidate must not be registered to more than one PAN.

- There should be a working cell phone number that will be used to register with the Aadhaar Card.

- The candidate must not have an Aadhaar system already linked to some other PAN.

- The whole process is online. The candidates are not required to present any of their documents.

Process To Apply Instant PAN Card Online

The candidate must follow in detail a step-by-step process while applying for an Instant PAN Card. The steps are listed below:

Step 1: First of all, the Individual has to open the Income Tax portal https://www.incometax.gov.in/iec/foportal

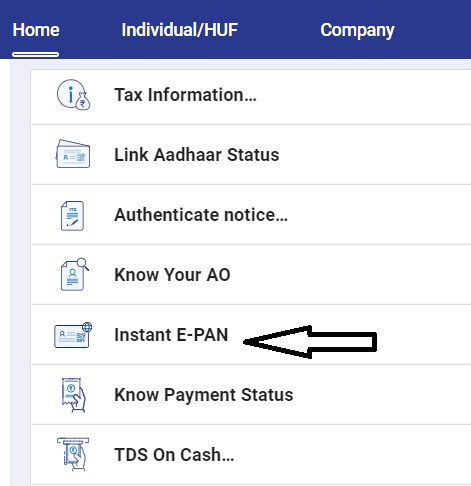

Step2: Now the individual has to look for the button which says “Instant e-PAN“, it is available on the left side of the navigation.

Step 3: A new page will appear which has the option to get a new e-PAN or to check the status of e-PAN application. As we are applying for a new instant PAN we have to click “Get New e-PAN“

Step 4: Now the individual has to enter 12 digit Aadhaar in the space provided and click continue.

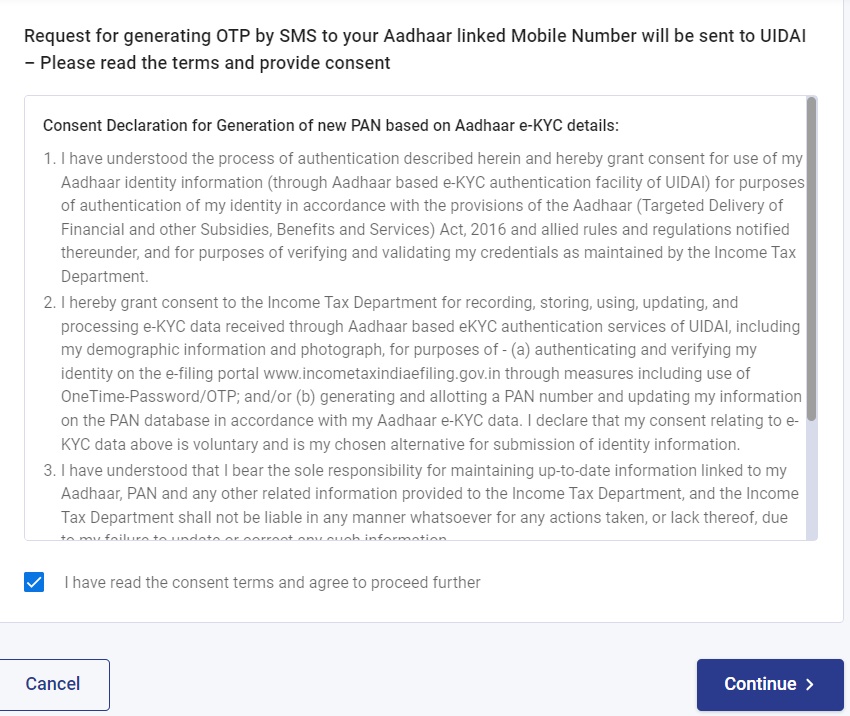

Step 5: You will be asked to read the terms and conditions, click the check box to accept, and click Continue

Step 6: An OTP(One Time Password) will be generated and sent to the mobile number linked with the Aadhaar number. Enter the OTP received on the space provided and click Continue.

Step 7: In the next step, your personal details like Photo, Aadhaar number, Name, Date of birth, Gender, Mobile number, Email id, and Address based on Aadhaar eKYC will be displayed. If the details are correct click on the checkbox which says “I accept” and click “Continue“

After that, the candidate is provided with an acknowledgment number that is required to check the status of Instant e-PAN.

How To Download E-PAN Card & Check Status

If all the information provided is accurate, downloading the PAN Card will be considerably simpler. Written below are the steps that one should follow to download the PAN Card from the official Income Tax website:

- The candidate is required to visit – https://www.incometax.gov.in/iec/foportal – the official web page of the Income Tax department for e-filing.

- Then, the candidate must click on the link for Instant e-PAN, which is situated on the left side of the navigation.

- The candidate must select the link – Download PAN/ Check Status.

- In a blank space, it will ask for your Aadhaar number. The candidate must fill it out along with the captcha code. After selecting the Submit option, an OTP will be created and sent to the Aadhaar linked cell phone number.

- The candidate must submit the valid OTP on the provided link.

- The candidate then can check the application status on the following page of the screen, and whether or not the PAN has been assigned.

- The candidate will be given a link to download PDF file. However, this is possible only when the PAN is allotted.