Recently updated on June 10th, 2022 at 12:18 pm

Jan Samarth Portal Registration, Login & Eligibility Criteria for various credit-linked government schemes at jansamarth.in

Today, Prime Minister Shri Narendra Modi launched the ‘Jan Samarth Portal’ jansamarth.in for credit-linked government schemes. The launch of the Jan Samarth Portal will make it easier to take loans under the government scheme.

Jan Samarth Portal will enable applicants to apply for loans under 13 government schemes. At present, there will be a facility to apply for four categories of loans. These include Education, Agricultural Infrastructure, business activity loans, and livelihood loans.

From loan application to its approval, everything will be done online through Jan Samarth Portal. Applicants will also be able to check their loan status on the portal. In case of non-availability of loans, applicants will also be able to complain online. The grievance of the applicant should be resolved within three days.

According to experts, along with the applicant, banks and various small and big credit institutions will also be available on the Jan Samarth portal, who will give their approval to the application for the loan. Presently, more than 125 financial institutions including banks are connected to this portal.

What is Jan Samarth Portal?

Jan Samarth Portal is a digital platform where 13 credit-linked schemes by the government are available, Beneficiaries can digitally verify their eligibility in easy steps, apply online for eligible schemes and also get digital approval.

How To Apply for a Loan at Jan Samarth Portal?

At present, there are 4 loan categories and multiple schemes in each loan category. For your preferred loan category, you will first need to answer a few simple questions, which will allow you to verify your eligibility. If you are eligible for any scheme then you will be able to apply online. After this, the applicant can get digital approval for the loan.

Jan Samarth Portal Registration

Step 1: Open the Jan Samarth Portal https://www.jansamarth.in/

Step 2: Click on the Register button on the top

Step 3: Enter Mobile Number and Fill Captcha Code

Step 4: A new pop up will appear for Privacy Policy, Terms & Conditions, and Disclaimer, Read all of them carefully and agree to them

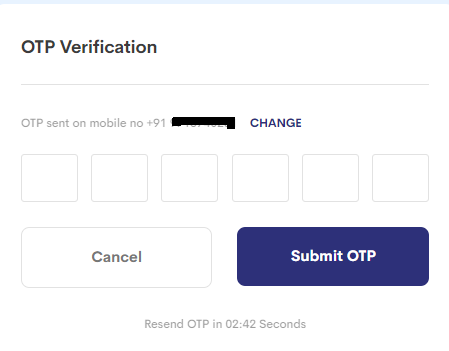

Step 5: Click on Get OTP, Enter the OTP in the space provided, and Click Submit OTP

Step 6: Enter the Email-ID and Click Submit OTP

Step 7: Enter the OTP received on your Email ID (Check your Spam Folder for OTP Received)

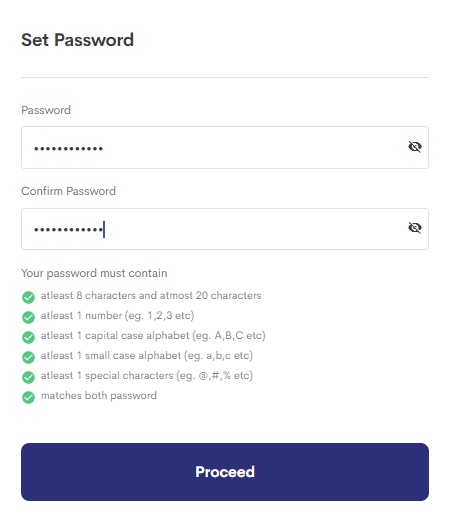

Step 8: Set Password

After successful login you can choose the scheme you want to apply for and Check your Eligibility by filling up the form.

List of Schemes Under Jan Samarth Portal

Education Loan Schemes

- Central Sector Interest Subsidy

- Padho Pradesh

- Dr. Ambedkar Central Sector Scheme

Agri Infrastructure Loan Schemes

- Agri Clinics and Agri-Business Centers Scheme(ACABC)

- Agricultural Marketing Infrastructure(AMI)

- Agricultural Infrastructure Fund (AIF)

Business Activity Loan Scheme

- Prime minister’s Employment Generation Plan(PMEGP)

- Weaver Mudra Scheme(WMS)

- Pradhan Mantri MUDRA Yojana(PMMY)

- Stand Up India Scheme

- Self Employment Scheme for Rehabilitation of Manual Scavengers(SRMS)

- Pradhan Mantri Street Ventor Atmanirbhar Nidhi Scheme(PMSVNidhi)

Livelihood Loan Scheme

- Deen Dayal Antodaya Yojana – National Rural Livelihood Mission(DAY-NRLM)

Can one apply for a loan?

Yes, any individual can apply for a loan. First of all, you need to check the eligibility for your required loan category, and if you are eligible, you can apply for the loan through the online application process.