Recently updated on November 6th, 2023 at 06:39 pm

Contents

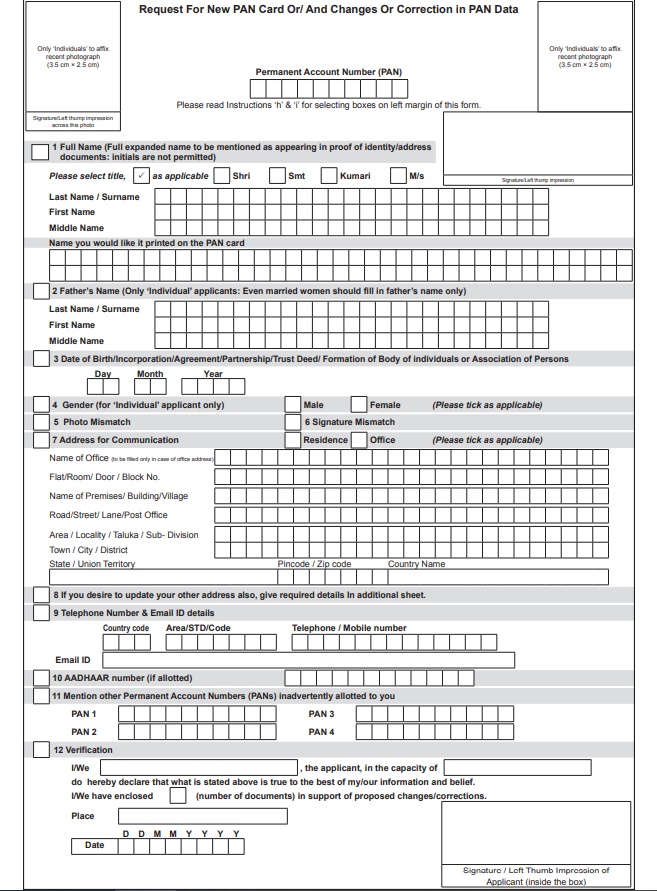

PAN Card Correction Form PDF

In this article you will learn how to download PAN card correction form pdf, How to fill correction form PAN card to make any changes to PAN card details, fees required for PAN Card correction form, time taken to update pan card online, and the list of documents required for PAN Correction form.

PAN Card(Permanent Account Number) is an important document for financial transactions in India, It consists of a 10-digit alphanumeric number issued by the Income Tax Department. PAN Card is required to file income tax and other financial transactions such as depositing more than 50,000 cash in a bank account, investing in mutual funds, buying shares, opening a Demat account, etc.

When a person applies for PAN Card, he needs to fill in his full name, date of birth, father’s name, and address, and submit his photograph and a sample signature. These details are then verified by the Income Tax Department and a PAN card is issued to that person having a unique number printed with the details of the person.

Download PAN Card Correction Form PDF 2023

Any individual who is 18 years of age can apply for a PAN card, the applicant can be an Indian citizen or a foreign national. The process of applying for a PAN card correction is simple and can be done both offline and online. For online PAN applications, there are two dedicated government websites –

- NSDL website

- UTIITSL website.

The government has delegated authority to these two organizations to issue PAN cards and accept applications for changes or duplicate PAN cards. These websites’ application forms are simple and specify all of the instructions. You must complete the form and submit it along with the processing fee and the required documents.

If you cannot submit the documents online, you may send them to any NSDL or UTIITSL service unit via registered mail. If you’re facing issues looking PAN card correction form pdf we will provide you with the pdf format of the application form below.

How to Update PAN Card Online (PAN Card Correction Online)

If you need to make any changes or corrections to your PAN (Permanent Account Number) card, you can easily do so online. Here re the steps to update your PAN card information online:

- Visit the official NSDL websites https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

- Select Application Type as “Changes or Correction in Existing PAN Data “

- Now Select Application Type from the dropdown menu.

- Enter your Name, DOB, Email ID, Phone Number, PAN Card, and Click submit after filling the Captcha code.

- Now Click on button which says “Continue with PAN Application Form“

- Now Select the way you want to submit documents, Choose “Submit digitally through e-KYC & e-Sign (Paperless)“

- Check whether you require physical PAN or Not

- Enter last four digits of your Aadhaar Card.

- Be sure to select the checkboxes next to the specific details you want to modify. For instance, if you are correcting the spelling of your name, provide the correct spelling and tick the checkbox located on the left side.

- Fill out details you want change

- Double-check all the information you’ve provided and submit the form.

- After your changes are confirmed, you will receive a 15-digit acknowledgement number. Keep this number handy as it will be essential for any future communication or to track the status of your application.

- Make the required payment, print out the acknowledgement, attach the necessary documents, and send the package to the following address:

By following these steps, you can efficiently update your PAN card online.

Correction form PAN Card pdf download Form 49A

When Should You Apply For PAN Card Correction?

When a Permanent Account Number (PAN) has already been assigned to the applicant, but data affiliated with the PAN (e.g. name of applicant/father’s name/date of birth) needs to be updated in ITD records, this application should be used. In such cases, the applicant receives a new PAN card with the same PAN but updated information.

Documents Required For PAN Correction Form PDF 2023

The applicant must submit the application documents to support their pan card correction application form to update any details on the current PAN card or to apply for a duplicate of the PAN card in the event of any loss, misplacing, or even theft. Below mentioned are a few necessary documents required while the whole procedure.

For Indian Citizens

- ID Proof

- DOB Proof

- Address Proof

- Voter ID card with Photograph

- Adhaar Card

- Ration Card

- Passport

- Bank Account Statement

- Bank Certificates

- Domicile Certificate

For Foreign Citizens

- Passport

- PIO card

- OCI card

- Taxpayer identification card

- Bank Account Statement

- VISA

For Businesses

- Company Registration Certificate

PAN Card Correction Form Fees 2023

A certain amount of money is needed for both the online and offline PAN card correction processes. Depending on the contact address, the fees change.

| Indian contact information | 110 |

| Contact information outside of India | 1,020 |

Get Your PAN Information Corrected

Everyone who has paid the fees gets an acknowledgment slip with a 15-digit number. You can check the status of your PAN card correction application using this number on the NSDL website.

Overall, PAN cards are significant legal records. Therefore, to constantly update accurate information, it is imperative to have a thorough understanding of the PAN correction process, both online and offline. Hope this post will be helpful.