Recently updated on June 27th, 2023 at 05:42 pm

Contents

- 1 Introduction – Sukanya Samriddhi Yojana

- 1.1 How to Link Sukanya Samriddhi Yojana Account in PNB Net Banking

- 1.2 How To Make Payment to SSY Account in PNB Net Banking Online

- 1.3 Sukanya Samriddhi Yojana Rules

- 1.4 How many years need to pay for Sukanya Samriddhi Yojana?

- 1.5 What is the Sukanya Samriddhi Interest Rate?

- 1.6 Is Sukanya Samriddhi Interest Taxable?

- 1.7 How many times deposits is allowed in Sukanya Samriddhi Yojana?

- 1.8 Is premature closure of the SSY account possible?

- 1.9 How the contribution can be made in SSY account?

- 1.10 What are the documents required for opening an SSY Account?

Introduction – Sukanya Samriddhi Yojana

The Sukanya Samriddhi Yojana is a saving scheme introduced by the Government of India for the girl child under the Beti Bachao Beti Padhao campaign. The deposits in the Sukanya Samriddhi Yojana come with tax benefits under Section 80C of the Income Tax act.

The account in Sukanya Samriddhi Yojana can be opened in the name of the girl child at the time of birth till she attains 10 years of age. A minimum deposit of Rs 250 per year is needed for the account to be active. One can deposit a maximum of Rs 1.5 Lakh in a financial year( 1st April to 31st March).

The account will mature after 21 years from the date of opening of the account, Partial withdrawal of 50% is allowed after the girl turns 18. The Sukanya Samriddhi Yojana account can be opened in any bank or post office by submitting the documents required. Once the account is opened in any bank you can choose to link it to your net banking account and deposit contribution online.

In order to link Sukanya Samriddhi Account in PNB Net Banking, one must have an active PNB Net Banking account with the bank. If you don’t have PNB Net Banking Account you have to register for PNB Netbanking which we have already discussed in our previous posts. In this article, we will discuss the steps involved in the linking of the Sukanya Samriddhi Account to PNB Net banking.

How to Link Sukanya Samriddhi Yojana Account in PNB Net Banking

1. Visit PNB Netbanking website https://netpnb.com/

2. Click Retail Internet Banking from the right-hand side

3. Enter UserID and Password to log in to PNB Internet Banking

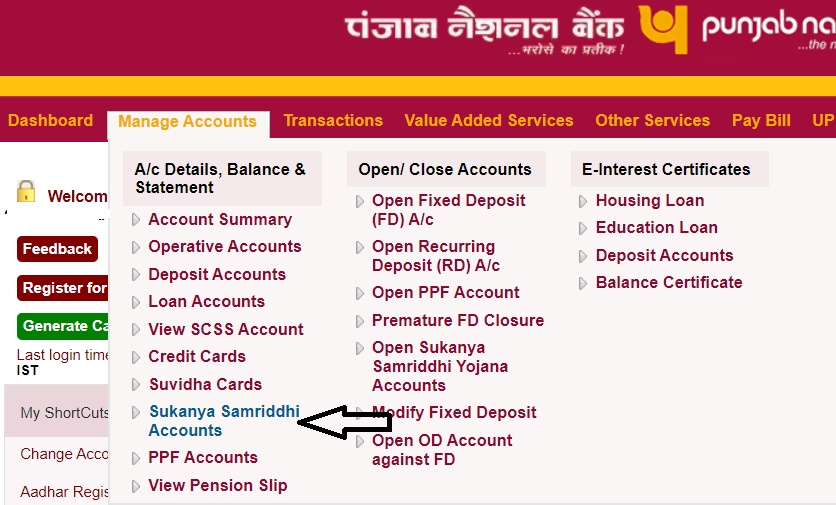

4. Click on Manage Accounts

5. Select Sukanya Samriddhi Account

6. Click Online Sukanya Account Linking

7. Select Operative Account(Choose Your Saving Account here)

8. Enter the Child’s Date of Birth and Click Submit

9. The Sukanya Samriddhi Account is now listed, follow the instructions and the account is now linked to your PNB net banking.

From now on you can make a deposit to the Sukanya Samriddhi account online via PNB Netbanking and there is no need to visit the branch for depositing contributions. If you don’t have access to PNB Net banking you can register for PNB Netbanking online by using your debit card and mobile number.

How To Make Payment to SSY Account in PNB Net Banking Online

- Open PNB Netbanking website

- Click Retail Banking Login

- Enter User ID and Password, Enter Captcha, and log in to the website

- Under manage Accounts click “Sukanya Samriddh Account”

- Now details of Sukanya Samriddh Account already linked to PNB Netbankig will be visible here

- Click “Make Payments”

- Now select the account from which you want to make a payment

- Enter the amount you want to transfer(minimum 250)

- Select standard remark, click continue

- Enter the Transaction password and make the payment

Sukanya Samriddhi Yojana Rules

The various rules for opening a Sukanya Samriddhi Yojana account are as follows:

- Only one account per girl child can be opened

- Only parents or legal guardians can open the account for the girl’s child

- The age of girl must be below 10 years of age at the time of opening the account

- The girl must be a resident of India

- Only 2 accounts per family are allowed, the third account is allowed in the case of twin girls born after first girl

- A minimum sum of rs 250 must be deposited every year to keep the account active.

- A maximum of Rs 1,50,000 can be deposited in a year

FAQ Sukanya Samriddhi Yojana

To keep the Sukanya Samriddhi Account active one must deposit money for 15 years from the date of opening the account.

The interest rate for the current financial year 2022-23 is 7.6% annually

No, the interest earned in Sukanya Samriddhi Yojana is not taxable

There are no restrictions on the number of deposits made per month or in a financial year. The contribution to Sukanya Samriddhi account can be made any number of times.

Premature closure of SSY account is possible in case of death of account holder(girl child), or the death of parent/guardian, or if the girl child’s address is changed.

The contribution can be deposited to SSY account via cash/ cheque/ demand drafts or via online transfer through net banking.

Birth Certificate of Girl Child, Aadhar Card of both Girl Child and Parent/Guardian, PAN of Parent/Guardian