Contents

The simple method to register in Traces as Taxpayer for the first time, download Form 26AS from Traces, perform 26QB corrections and verify the TDS certificate.

What is TRACES?

TRACES is an acronym for TDS Reconciliation Analysis and Correction Enabling System. It is an online platform launched by the Income Tax Department to enable the correction of previously submitted TDS returns. TRACES streamline the rectification process thus eliminating the need of filling in revised returns which saves time and avoids complications.

Traces Registration As Tax Payer Complete Process

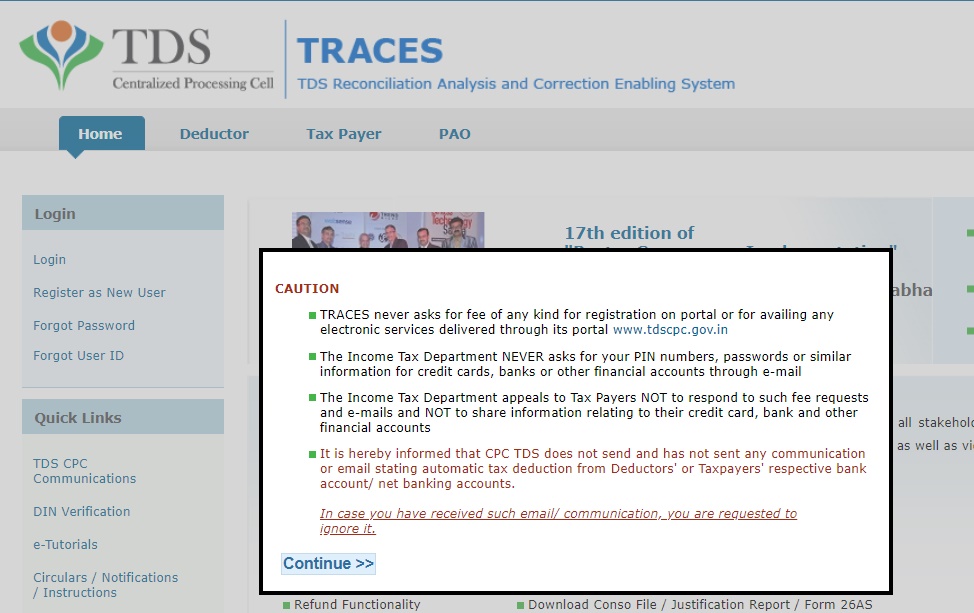

Step 1: Open the website https://contents.tdscpc.gov.in/ in the web browser, a popup window will appear just click on the continue button at the bottom.

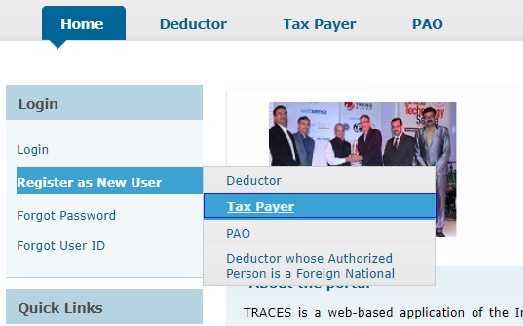

Step 2: Click on Register as New User link and Select Tax Payer from the sidebar

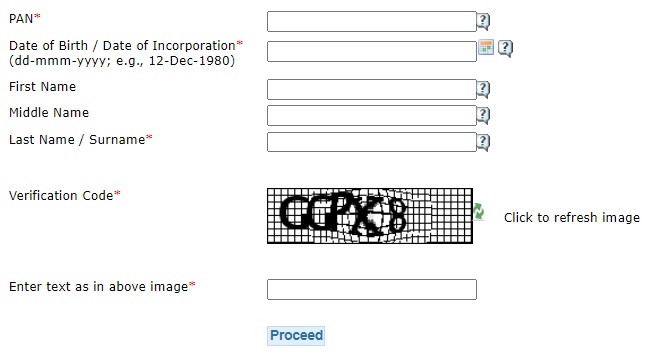

Step 3: A new form will appear, fill in the PAN number, Date of Birth, First Name, and Last Name as mentioned on the PAN card, fill verification captcha code and click Proceed(If you have only the first name on the PAN card then enter your first name in place on the last name field and keep first name blank)

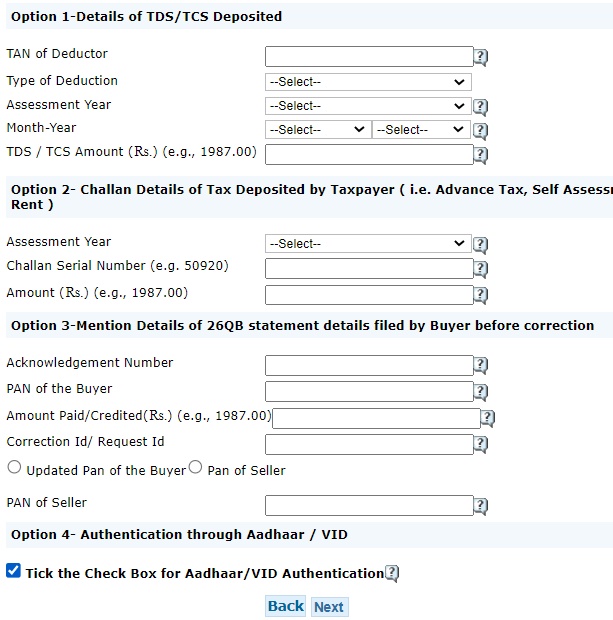

Step 4: Now you are provided with four options,

- Option1: Details of TDS/TCS deposited

- Option2: If you have challan details of Tax deposited

- Option3: Details of 26QB form submitted by the buyer

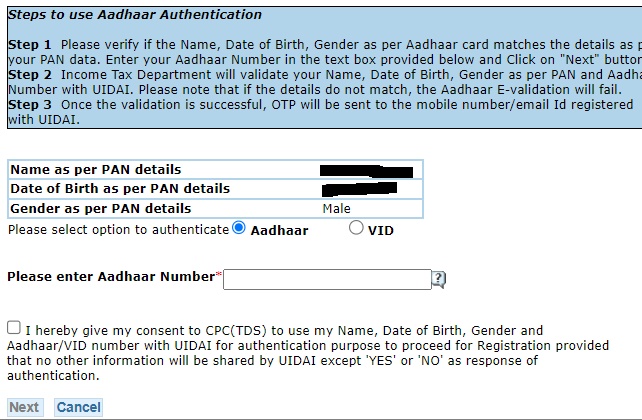

- Option4: Authentication through Aadhar or virtual ID

If you don’t have any information about Option 1,2 and 3 you can directly Tick the check box for Aadhaar, Virtual ID Registration, and Click Next

Step 5: Enter your Aadhar number and Click Next

Step 6: You will receive an OTP on your mobile number linked with Aadhar card

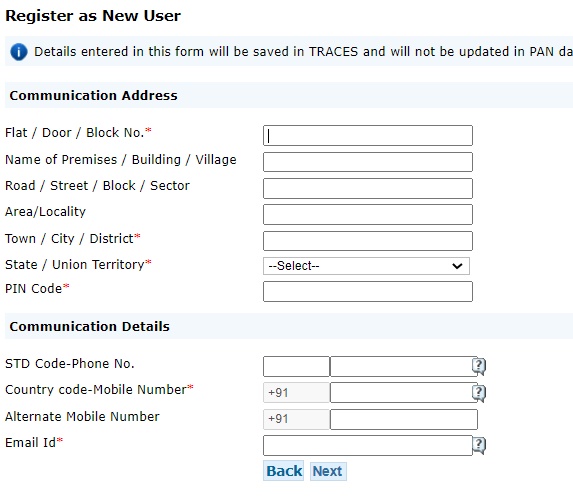

Step 7: Fill in your address, mobile number, and email id and click next

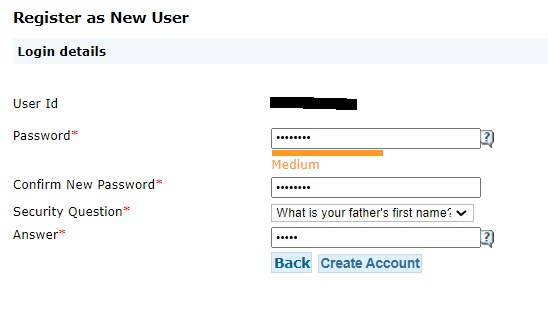

Step 8: Now you will be asked to set a password and add a security question after filling in the details click on create account

Step 9: Verify the details entered in the next step and Click Confirm

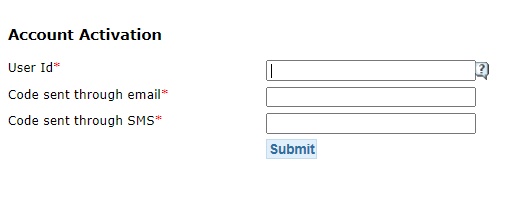

Step 10: Now an activation link will be received on the email ID, click on the link and enter the code received on the email and SMS on the space provided.

Functions of TRACES Website

The various functions available on TRACES website are as follows”

- File for correction in TDS/TCS statement

- View status of challan paid

- Download or view Form 26AS

- Check the status of various tax statements online

- Make refund request