Recently updated on January 30th, 2024 at 11:37 am

Easy process for LIC Loan Interest Payment Online through the LIC Customer portal, Online LIC Loan Interest Payment Without Login, or making LIC loan payment Online Paytm

Contents

Loan Against LIC Policy – Introduction

Loan Against LIC Policy is a loan taken by policy holder against his/her existing policy. It is a kind of secured loan where LIC policy acts as a security for loan amount taken. The LIC policy holder can take a loan upto 90% of the current surrender value of the policy. This loan can be used for any purpose such as financing a business, meeting medical expenses, paying off debts, etc. The interest rate on this loan is usually around 6% which is lower than other types of loans.

History of LIC

LIC or Life Insurance Corporation of India is one of the largest companies in terms of customer base and it is also India’s most trusted brand. LIC was incorporated in the year 1956 under the LIC Act, It is controlled and owned by the Government of India. LIC customers can make LIC premiums payments, LIC Online Loan interest payments, LIC Loan repayment, and other fees through the customer portal using login details or through the LIC website without login.

Life Insurance Corporation of India also has partnerships with popular mobile payment apps like Paytm, Phonepe, and Google Pay for making LIC payments online. One can easily pay LIC premiums or LIC Online Loan Interest payment using these apps or LIC customers can also use the LIC website to make such payments.

LIC is also going to be listed on the stock exchange on May 17 2022 for which the IPO will be open from May 4 to May 9. There is a provision for LIC policyholders to buy shares of LIC under the RIB or Non-Institutional Bidders categories. It is mandatory for policyholders to link their LIC policy to PAN cards, so if you are interested in purchasing LIC shares you must link your LIC policy to your PAN Card before the due dates.

LIC Loan Interest Payment Online Through Customer Portal

In order to pay LIC online loan Interest payment through the Customer Portal, one must have access to the LIC customer portal. If you have created your Login ID, and Password and registered your LIC policy successfully at the LIC customer portal, then you can easily pay LIC Loan interest payment online through the customer portal. Follow the below steps to pay the interest due on the LIC policy loan.

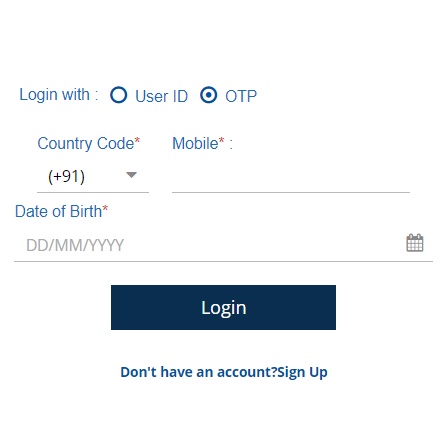

Step1: Open the LIC Customer Portal https://ebiz.licindia.in/D2CPM/#Login

Step 2: Choose the way you want to Login (With user Id or With OTP)

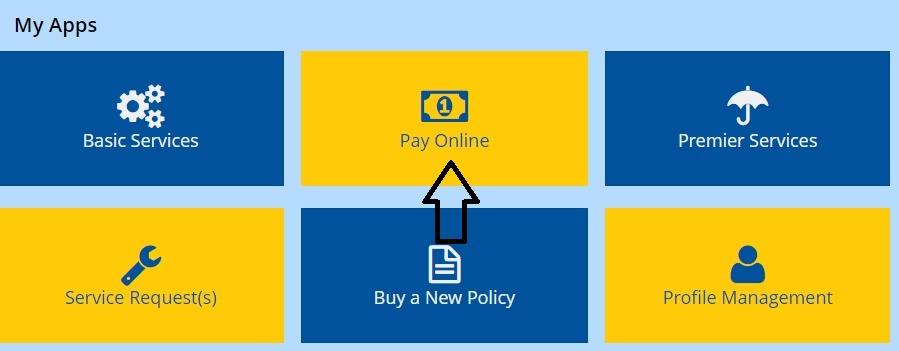

Step 3: Once you Login Successfully to LIC portal, Click Pay Online tab

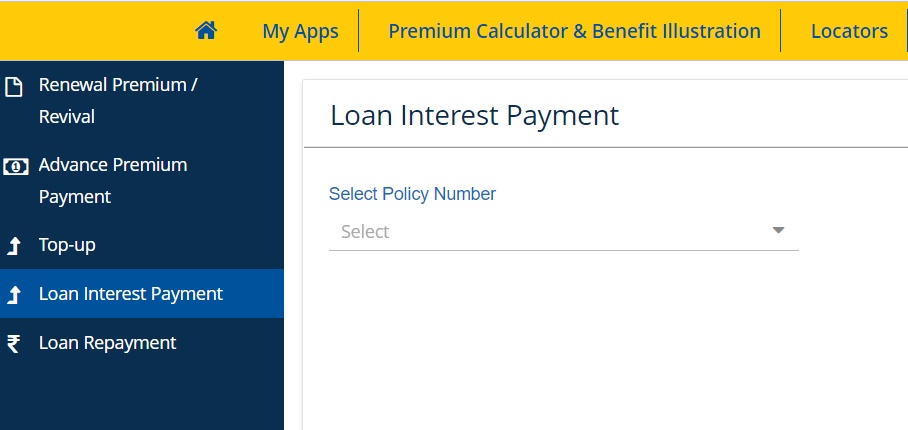

Step 4: Select Loan Interest Payment

Step 5: Now Select the Policy Number for which you want to make a payment

Step 6: The amount of interest pending for the policy entered will be shown here, now you can make the pending LIC loan payment using Netbanking, Debit Card, Credit Card, etc.

LIC Online Payment Without Login

If you are not a registered member on LIC portal or you want to pay Loan Interest for other user whose policy is not listed in your account then you can do the same without login to LIC portal. Follow the steps mentioned below to pay LIC policy loan interest payment without user ID and password.

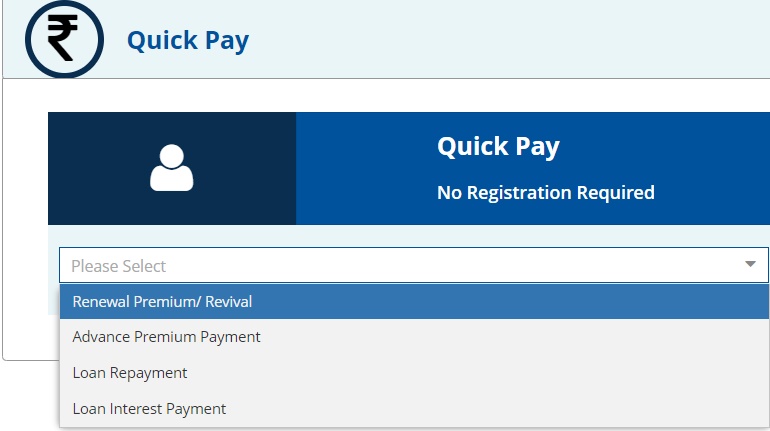

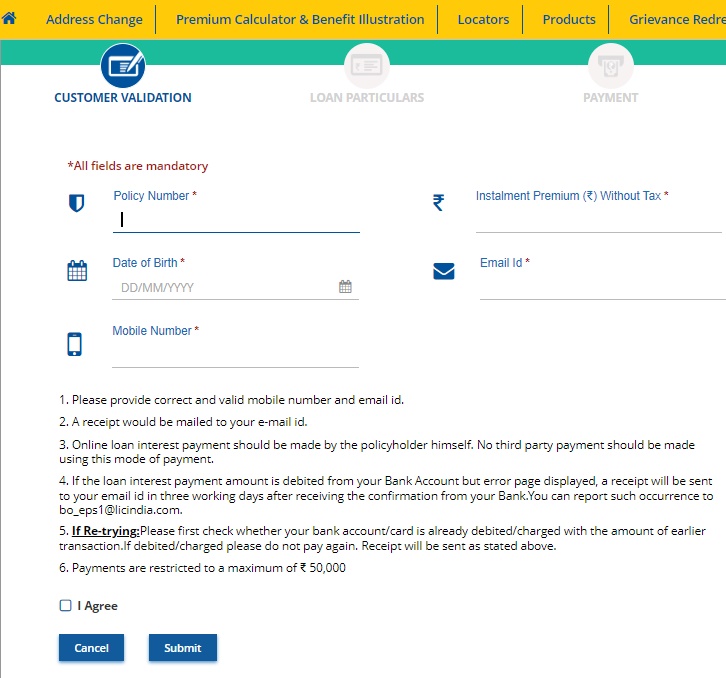

Step 1: Open the website https://ebiz.licindia.in/D2CPM/#DirectPay

Step 2: Select Loan Interest Payment from the drop-down menu

Step 3: Click Proceed button on next page

Step 4: Now Enter the Policy Number, Date of Birth of the policyholder, mobile number, Installment premium amount, and email id

Step 5: Click the check box which says I Agree then Click Submit button

Note: A maximum sum of Rs 50,000 can be paid using the above method of payment.

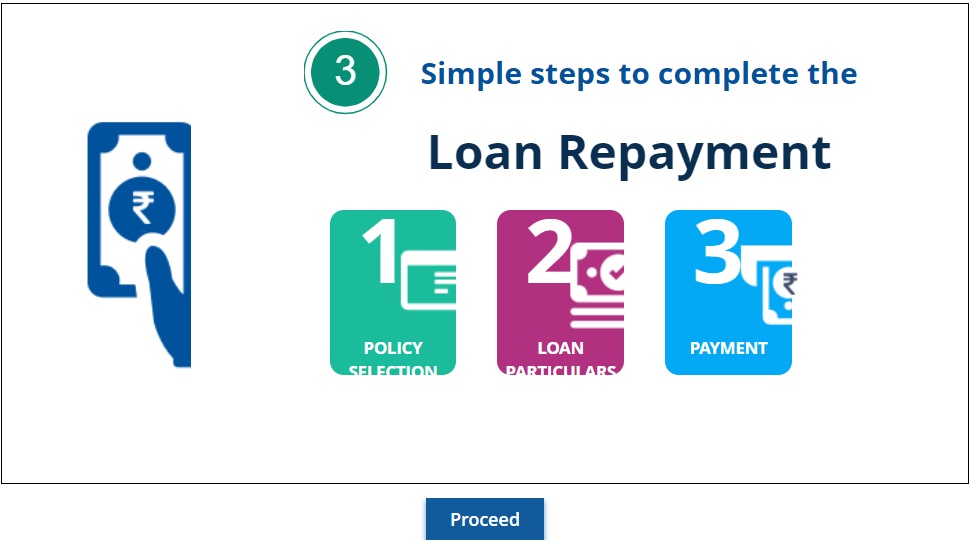

LIC Loan Repayment Principal Process

If you have also taken a loan against LIC policy and now you are in the condition of paying off the loan or you want to deposit some amount of the loan then also you can make the loan repayment through the LIC portal. The various steps involved in the LIC Online Loan Repayment process are as follows.

Step 1: Login to Customer Portal with Login ID and Password

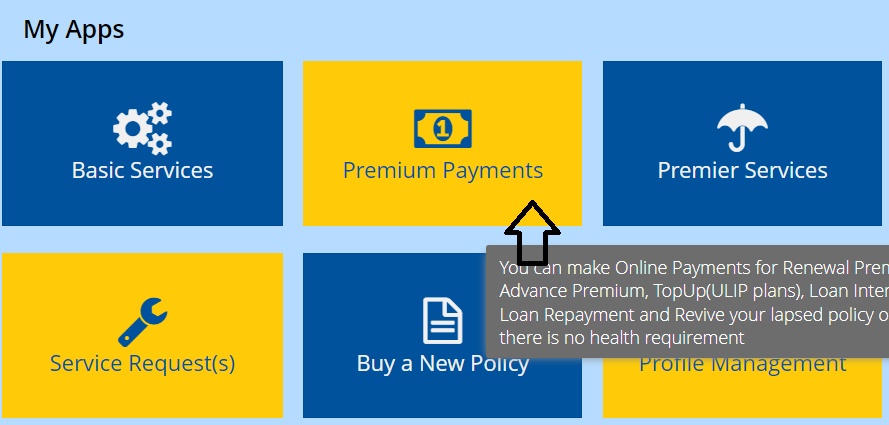

Step 2: Click on Premium Payment tab as shown in the image

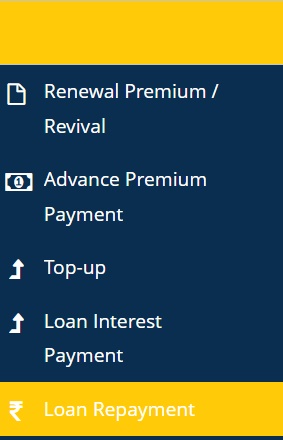

Step 3: Select Loan Repayment from side menu

Step 4: Click on Proceed button on next window

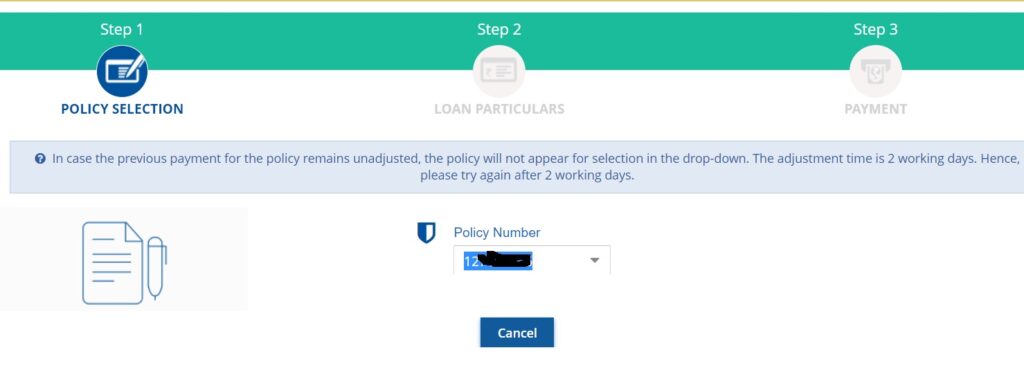

Step 5: Select policy number from drop-down menu

Step 6: Enter the amount you want to repay and pay using the Net banking or Credit Card.