Recently updated on July 11th, 2023 at 05:27 pm

In this article you will know details about BBMP property tax, bbmp tax calculation, process for BBMP property tax payment, how to download receipt et. BBMP property tax paidreceipt download.

Contents

BBMP Property Tax 2023 – Update

The last date for 5% rebate in BBMP Property Tax is 30th June 2023, To save money on property tax property owners must pay their BBMP tax on or befor 30th June as no extension of last date wil be provided after that. On June 22nd while replying a question on proposal of increase in property tax DK Shivakumar, the current Deputy Chief Minister and Bengaluru Development Minister urged BBMP to streamline the SAS (Self Assesment Scheme) for BBPM tax and focus on increasing revenue.

BBMP Property Tax – Introduction

The BBMP property tax is a direct tax imposed by the Karnataka State Government and collected through BBMP (Bruhat Bengaluru Mahanagara Palike). The payment of BBMP tax can be done online vir BBMP tax website https://bbmptax.karnataka.gov.in/. The BBMP tax collected is used to provide various ameneties and maintaining infrastructure of the city.

The BBMP tax is collected anually and a rebate is also provided if the property owner pays the BBMP tax within the speculated time. The process of BBMP tax payment is simple and user-friendly provided that the property owner know their 10 Digit Application No (or) PID No (or) 2008-2015 Renewal Application No.

The BBMP property tax is charged on the basis of Unit Area Value(UAV) of property, which is calculated based on on the nature of property, location of property and anticipated return from the property. Bengaluru is divided into six zones for calculation BBMP tax, The tax rates of these six zones ranges from Rs1 psf to 2.80 psf.

How To Make BBMP Tax Payment Online

The step-by-step process forBBMP tax payment online is as follows:

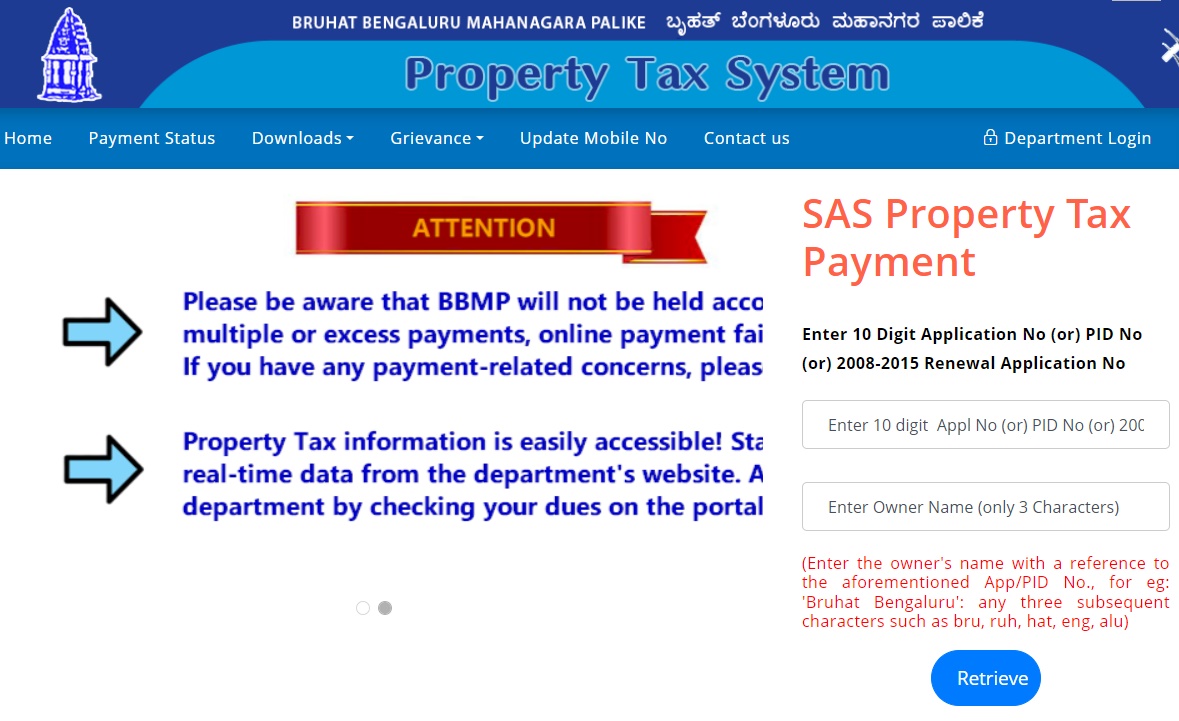

- Step 1: Open the BBMP Tax Website for payment of BBMP Property Tax payment https://bbmptax.karnataka.gov.in/

- Step 2: Enter 10 Digit Application No (or) PID No (or) 2008-2015 Renewal Application No. in the space provided adn Enter first three letters of owner name and CLick Retrieve button

- Step 3: Now the details of property matching the details you entered will populate on the screen, After verifying the details are correct click on Proceed button which redirects you to Form IV

- Step 4: If you want to make any changes, Click the checkbox and click Proceed butt

- Step 5: Now a new Form V will open, Fill in details and Click to Pay BBMP Property Tax online payment.

- Step 6: Pay the pending BBMP tax through Net Banking or Card.

- Step 7: After 24 Hrs you can download BBMP tax paid receipt

How To Download BBMP Tax Paid Receipt

- Open the BBMP Tax Payment Website https://bbmptax.karnataka.gov.in/Default.aspx

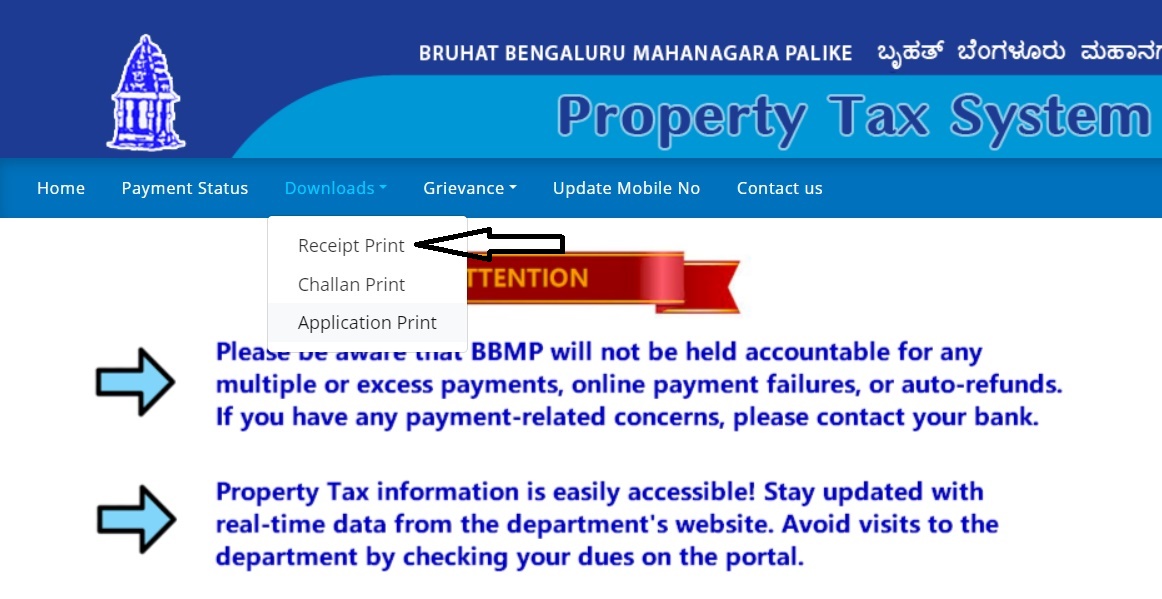

- Click on Download from menu, Now Select Application Print

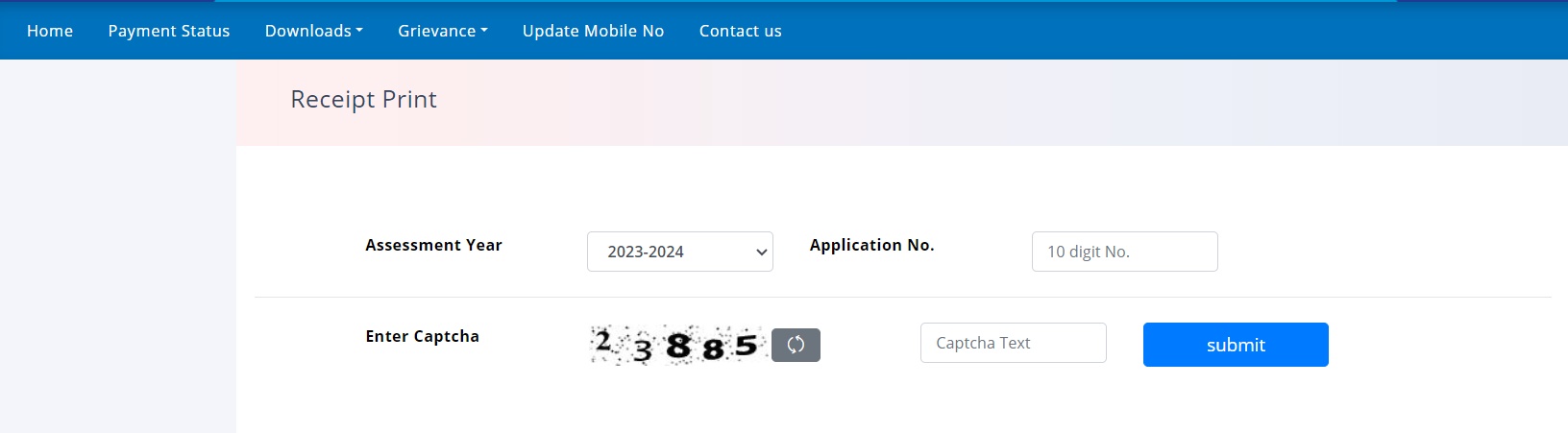

- Now Select the Assessment Year, Enter Application NUmber and Fill Captch Code and Click Submit button

- The bbmp tax paid receipt is now visible on screen, Download the receipt for any future references.

How to Calculate BBMP Property Tax?

The general formula for property tax calculation is: Property tax (K) = (G – I) * 20% + cess (24% of property tax)

Here:

- G represents the Gross Unit Area Value (Gross UAV), calculated as X + Y + Z

- X represents the tenanted area property * sq. ft unit rate per property * 10 months

- Y represents the self-area sq. ft property * sq. ft unit rate per property * 10 months

- Z represents the vehicle parking area * sq. ft rate per vehicle parking area * 10 months

- I represents G * H / 100, where H is the percentage depreciation value

BBMP Tax Forms

The following forms are required for BBMP tax payment:

- Form 1: For properties with Property Identification Number (PID), including street number and ward number (for erstwhile BBMP properties)

- Form 2: For properties without a PID, but with a Khata number (for erstwhile CMC and TMC properties)

- Form 3: For properties without a PID or Khata number, typically unauthorized properties (green form)

- Form 4: For properties with no changes in usage or occupancy (white form)

- Form 5: For properties with a change from residential to non-residential usage (blue form)

- Form 6: For exempted properties (white form)

The BBMP is responsible for property tax collection in Bangalore. Property owners must fulfill their tax obligations to contribute to the development of civic amenities in the city. Property tax rates vary across different zones, and payment options include online, manual, and challan modes. Stay informed about the calculation methods, payment deadlines, and rebate eligibility to ensure a smooth property tax payment process in Bangalore.

Frequently Asked Questions

How do I pay my property tax online BBMP?

How can I download my old BBMP tax receipt?

2. Click Download > Receipt Print

3. Choose the Assesment Years, Enter Application number and fill captcha

4. Cick Submit and the recept is now available to download.