Recently updated on April 3rd, 2023 at 01:09 pm

Link Aadhaar To PAN – Introduction

Following the Supreme Court’s ruling, it is now mandatory to link Aadhaar with PAN Card(Permanent Account Number) in order to file and process Income Tax Returns (ITR), request a new PAN card, and get a number of benefits both from the State and the Central Governments. The government has extended the deadline for linking PAN card to Aadhaar till June 30th, 2023 with the late fee of Rupees 1000 after which the PAN card shall become inoperative. The Aadhaar number is linked automatically during the process for new PAN card applicants.

Also Read:

- Update Address in Aadhaar Card Online

- Link PAN Card to LIC Policy

- Search PAN Card Details By Name, DOB

How To Link PAN Card with Aadhaar Online

The online approach has made it simple for everyone with internet access to link their Aadhaar and PAN numbers. Here is a step-by-step breakdown of the entire procedure:

- Visit the Income Tax e-Filing Website, the official website of the Government of India’s Income Tax Department, at https://www.incometax.gov.in/iec/foportal

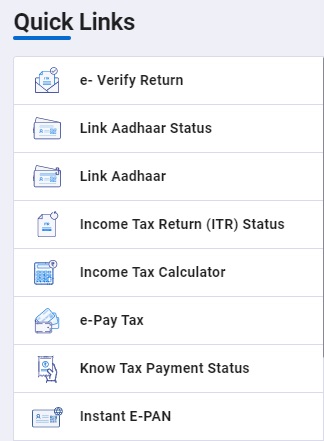

- Find the “Link Aadhaar” option in the “Quick Links” section on the website’s left side and click on it.

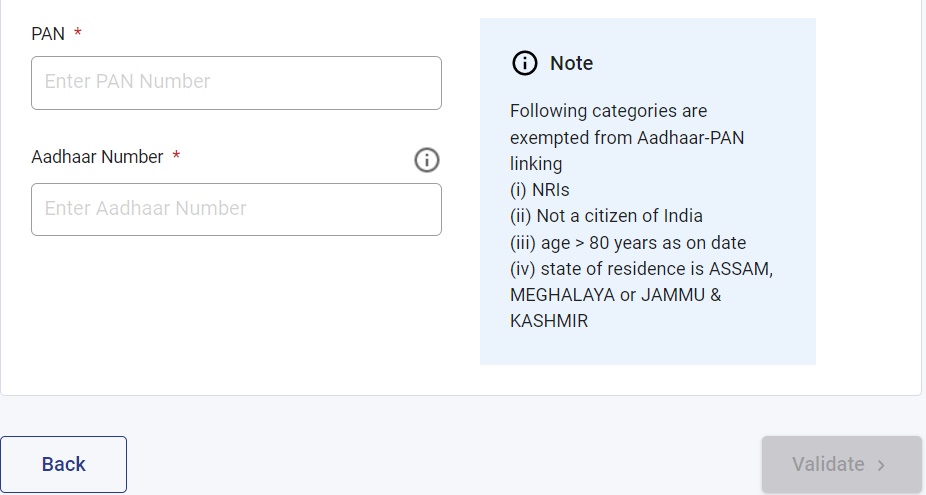

- Fill out the necessary information on the next page, including your PAN card number, and Aadhaar number, and Click on Validate button.

- If the Aadhaar card simply contains the date of birth, check the box and mark it as checked. If not relevant, disregard it.

- Please check the box next to “I agree to authenticate my Aadhaar details with UIDAI” before moving on.

- A “Captcha Code” is offered for correct verification; enter the code in the box located directly below the image.

- By clicking on the square that has the “Request Captcha” option, visually impaired users can apply for OTP without entering the Captcha code.

- Before selecting the “Link Aadhaar” option at the conclusion of the form after the verification procedure is complete, it is advisable to double-check the information.

- A pop-up notice indicating the completion status of your linked Aadhaar with PAN card will appear as soon as the page successfully loads.

How To Link PAN Card with Aadhaar With SMS

The government has offered other options for those who lack access to internet services. One can link Aadhaar with PAN cards using their mobile device in the following ways:

- Type the message in the following manner on the messaging app.

- UIDPAN <aadhaar number of 12 digits> <PAN number of 10 digits>

- The following step is to send a message from the registered mobile phone to any of the two numbers officially issued by the government, 567678 or 56161. (that is associated with Aadhaar or PAN cards).

- You will need to submit UIDPAN 123456789000 ABCDE1234F to the specified numbers if, for example, your Aadhaar number is 123456789000 and your PAN card number is ABCDE1234F.

How TO Check PAN Aadhaar Linking Status

If you are unsure or wish to confirm if the Aadhar and PAN cards are linked, you can quickly determine the situation by going to the official Income Tax e-Filing Website. The steps are as follows:

- Open the Income Tax Portal https://www.incometax.gov.in/iec/foportal/

- Click “Link Aadhaar Status” from Quick Link Section

- Enter you Aadhaar Number and PAN Card number.

- Now Click View Link Aadhaar status

- A popup will appear with the message if the Aadhar and PAN details entered are linked or not.

HOW TO CORRECT ERRORS WHILE LINKING THE ADHAAR CARD WITH THE PAN CARD?

Only accurate and valid information is provided in the documents and only then is the PAN-Aadhaar linkage successful. The PAN will not be linked to Aadhaar if there are any problems or mismatches, and the necessary corrections can be made online using the official NSDL PAN webpage or by going to the closest Aadhaar enrolment center. The steps to make the required modifications online are listed below:

- Go to https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html to access the NSDL PAN website.

- You can submit applications here for either new PAN cards or corrections.

- Digitally sign the documents, and provide your PAN card information.

- You will receive a confirmation notification through email after everything is finished, at which point you can successfully link your Aadhaar number to your PAN card.

WHAT IF YOU CAN NOT LINK THE PAN CARD WITH YOUR ADHAAR CARD?

It is crucial to follow the instructions and handle the situation honestly because the government has made it essential to link an Aadhaar number to a PAN card, with the deadline extended to March 31, 2022, after which the linking of PAN card will attract a hefty fine. Checking whether the primary documents require any revisions is the first thing we need to make sure of. It is required that the documents have the same, accurate information, starting with our IDs.

CORRECTIONS IN NAMES ON THE PAN CARD:

- Visit the NSDL’s official website at https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html to submit an e-filing.

- From the drop-down menu in the “application type” section, click on “Modifications or Correction in existing PAN data” or “Reprint of PAN Card (No changes in Existing PAN Data)”.

- In the “Category” column, select “Individual,” then begin entering the appropriate information.

- Send the form in.

- You will be taken to a new page after the submission, where a token will be generated and shown to you. A letter will also be sent.

- Soon after, finish the Aadhaar KYC process and move on to the next stage.

- Carefully fill out every field, double-check your work, finish the payment, and then click the “Submit” button.

- Your residential address will receive your updated PAN card.

- You can quickly link your PAN to your Aadhaar after you receive it.

Ho To Change Name in Aadhar Card :

- Go to the neighbourhood Aadhaar Enrolment Center.

- Never forget to have self-attested copies of your identification on you.

- You will be provided with an Aadhar Enrolment Form, which you must complete and double-check.

- Submit the Aadhaar Enrolment Form along with the necessary supporting documentation.

- You will receive an acknowledgment slip with your update request number after submission.

- You can use this number to find out how your request for an Aadhaar update or correction is progressing.

- Once the process has been successfully completed, you can link your PAN card to your updated Aadhaar card.

Significance of Linking PAN to Aadhaar Card:

It is important to link your PAN card to Aadhaar card for the following reasons:

- After March 31, 2022, Linking PAN cards with Aadhar will attract a penalty.

- It is a technique the government uses to monitor, address, and end cases of several cards being issued in the same name.

- You will receive a summary of the taxes imposed on you for your future reference.